How to choose the right bike insurance?

Content

- Why Bike Insurance?

- Questions to ask yourself

- Wouldn't you be insured for your bike? (What if you were already insured?)

- Is your bike new?

- What kind of bike do you have?

- Have you ridden a bike yourself?

- What's the price of your bike?

- Are you a professional cyclist? Or do you go in for cycling, even if you are an amateur?

- What if you break your bike?

- Does your bike have anti-theft markings?

- Do you have an approved anti-theft device (SRA or FUB)?

- Comparison of valid bike insurance

When you ride a mountain bike or mountain bike worth several thousand euros, it is legal to protect your "investment" by considering bike insurance.

We've reviewed the offers on the MTB or VAE insurance market and, before posting a comparison of the major insurers, have compiled a list of questions you should ask yourself before deciding to insure your bike.

Note, however, that each case is unique and these few questions should help you choose the best ATV insurance that applies to YOU.

Why Bike Insurance?

In general, insurance is threefold:

- guarantees

- exceptions

- tariff

Just because your neighbor is happy with his does not mean that his bike insurance will be tailored to your personal situation.

It is also a highly regulated environment, insurers must obtain administrative approval from authorities representing the state to be authorized to carry out insurance operations.

A permit is issued to insurance companies to enable them to trade contracts. However, once issued, the administrative authorization is not finally granted, as under certain conditions it may become invalid or even revoked.

So check to see if the insurance you are targeting has FDA approval.

So, only one main rule: read contracts in detail ! We will warn you! 😉

Questions to ask yourself

Wouldn't you be insured for your bike? (What if you were already insured?)

... But, of course, not knowing about it! Indeed, owner or renter, you probably have home insurance coverage that may extend beyond your home. Thus, some types of insurance include damage and theft of bicycles outside the home. Before taking out new mountain bike insurance, first check with your insurer if your bike is covered and on what terms! If not, then nothing prevents you from trying to negotiate it!

Is your bike new?

Or, to be more precise: are you just (or are you about to) buy a bike? And yes, some insurances do not cover used bicycles and have very restrictive conditions regarding the subscription period after purchase: less than 6 days for the shortest, so don't miss the boat! Also note that many insurances offer maximum coverage for up to 2 years!

What kind of bike do you have?

MTB, Road, VAE, VTTAE, VTC, Gravel? Not all types of bikes are covered by systematic insurance: in fact, some insurances (yet?) Do not cover pedlecks or track bikes, and mountain bikes for downhill travel may have limitations on maximum fork travel 😊.

Have you ridden a bike yourself?

Some bike insurance only covers bicycles assembled and sold by a professional, and you will need to prove this by presenting an invoice and certificates from the person who assembled (at least).

What's the price of your bike?

It is clear what is the maximum amount you can receive in the event of a claim for your ATV! This question essentially arises if your bike is worth more than € 4/000, because if you want a new refund of this amount, very few insurance companies will be able to satisfy this request. So be wary of very high end mountain bikes or pedals that easily reach this order of magnitude.

Are you a professional cyclist? Or do you go in for cycling, even if you are an amateur?

There are special insurance policies for professionals. With regard to competitions, they can be provided in the case of amateur competitions directly or as additional options. Please note that during the competition, damage may not be covered, but only theft.

What if you break your bike?

Not all mountain bike insurances cover breakages!

And for those who have breakdown insurance, the terms of compensation can be very different: deductible or not, percentage of obsolescence, or even for some, compensation only if there is also a claimed bodily injury 🙄.

Does your bike have anti-theft markings?

From 1 January 2021, labeling of bicycles is mandatory in France. Some bike insurance will only cover your ATV against theft if it is marked or engraved, or will apply higher deductibles if it is not. For more information visit the bicycode website or about the different labeling methods used by recobike.

Be aware that if you have a carbon frame, engraving may void multiple manufacturers' warranties. So prefer the security insert if that's the case.

In the event of theft: how can I get insurance?

File a complaint with the police 👮 immediately and report the theft of your bike. A report (PV) will be forwarded to you at the police station or gendarmerie and you will need to report the theft of your bike to your insurance company. To act faster, you can fill out a preliminary complaint form online.

Contact your insurance company.

After you send the required parts (theft declaration, bike invoice, bike make and model), you will receive compensation in accordance with the terms of your contract.

Be responsive : Most insurances require a loss report to be made in the days after the theft. ⏲ Don't delay!

Do you have an approved anti-theft device (SRA or FUB)?

It is compulsory for certain types of insurance to be insured against theft, with proof of purchase (invoice before buying the bike or a photograph) and proof of correct use of the lock! It's not easy going on a hike with a castle that weighs over a kilo to stop in peace for a drink at a local bistro.

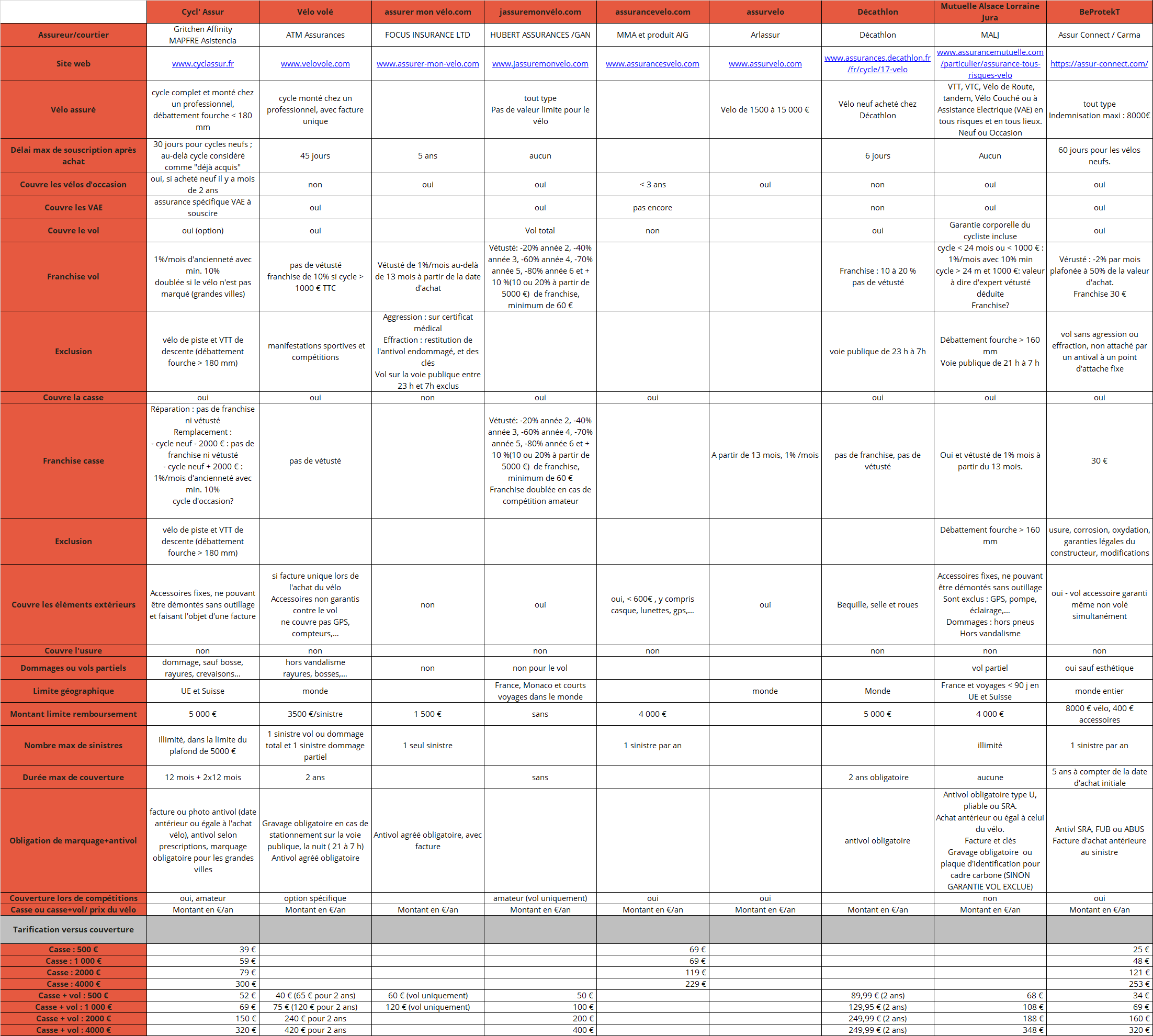

Comparison of valid bike insurance

Here is a summary of the main provisions of ATV insurance contracts in the table below.

Clicking on the table will download an Excel version of the file.

Feel free to give us your feedback so we can compare against developments that insurers are watching or new entrants to the bicycle insurance market.