How to insure the Jaguar at the cheapest rate?

Content

Jaguar Liability Insurance - How to find the best deal?

It's undeniable that Jaguar's OC premium isn't low. According to the Rankomat rating, the cars of this brand are at the forefront of the most expensive cars in terms of insurance. This is mainly due to the parameters of these vehicles. Big engines, high horsepower and great performance make drivers happy, but from an insurer's point of view, the combination is risky and can lead to high collision rates.

In the worst position were young drivers, whose first car was a Jaguar. They will definitely pay the most for the OC policy for this car. Pensioners, on the other hand, can count on significant discounts, which at least slightly compensate for the already rather high costs of maintaining a car.

However, it is worth considering that people who decide to buy cars from the premium segment will certainly not feel the high costs associated with insurance. Running powerful, sports cars is expensive in itself, if only because of the high fuel consumption combined with the price of gasoline. This includes any repairs and maintenance. Therefore, you need to know that the price of an OC policy is only a small part of the cost of using such a vehicle.

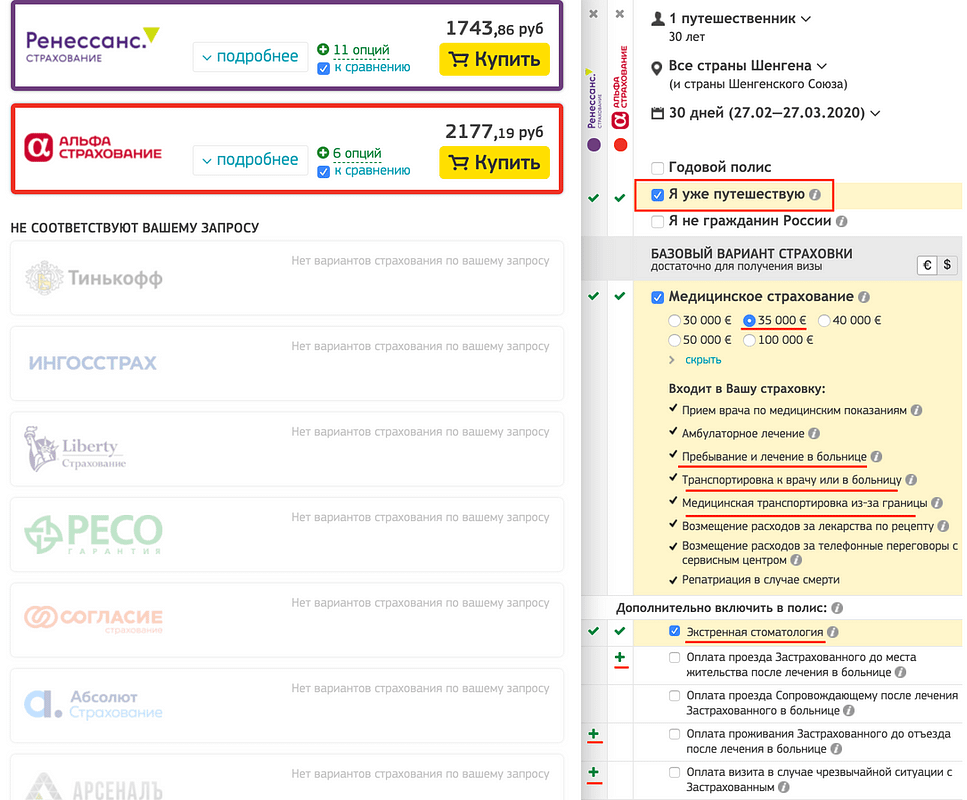

Nevertheless, it is worth finding out where you can buy the cheapest insurance, because it is never worth overpaying. First of all, check out the offers of individual insurance companies. Their offers can differ significantly, sometimes even by several hundred zlotys. The most convenient way to do this is to use online price comparison websites. Quickly and without leaving your home, you will have access to the price lists of dozens of insurers - in a few minutes you will check what they offer and make the right decision. You can read more about cheap Jaguar liability insurance here: https://rankomat.pl/marki/jaguar.

Jaguar liability insurance price - what does it depend on?

The cost that a Jaguar owner has to bear when buying a policy does not depend only on the parameters of his vehicle. Of course, engine size or mileage are important criteria, but not the only ones. Factors such as:

- driver age,

- place of residence,

- insurance history.

As already mentioned, young drivers are in the worst position. Due to their age, they are considered by insurance companies as a risk group, i.e. the one that causes the most accidents. Unfortunately, combined with Jaguar's very good performance, this is the basis for offering the highest premium.

The place of residence also matters. People from big cities usually pay the most. This is due to the fact that in such cities collisions most often occur. Mostly these are not serious accidents, but just parking bumps or minor accidents, but the statistics are relentless.

Thus, rates will be much lower in smaller centers, although this dependence does not always work directly. Insurers also pay attention to the province in which the owner of the vehicle resides.