What is car leasing: the pros and cons of using a car with the right to buy

Content

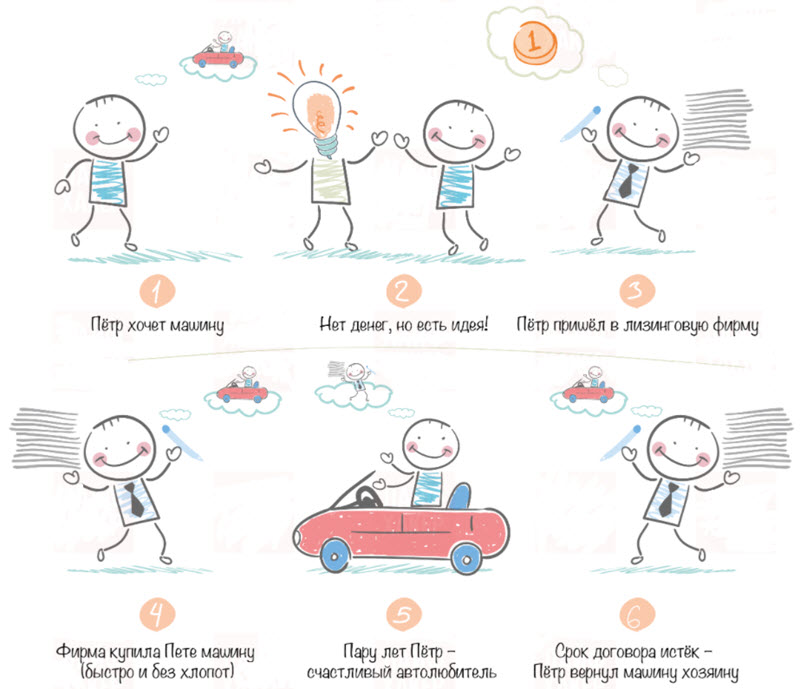

A lot of customers know about car leasing, but most don't really understand what it is and how it works. An easy way to describe leasing is to say it's like renting a car, but that's misleading.

What does leasing mean, differences from rent and credit

The meanings of leasing and renting basically mean the same thing. One of the differences is the duration of the rental of the property.

Leasing implies a longer term, for example, a year. You sign an agreement, undertake to stay in one place for a specific period of time and pay the required amount every month during this period.

If it concerns the car, then the scheme is almost the same. By signing the contract, you agree to pay a certain amount for a certain period for the use of the car.

Leasing and renting are somewhat similar. In leasing, you are required to draw up a contract and stick to it, but in a lease, a contract is not required.

The second difference lies in the number of participants specified in the contract.

Advantages and disadvantages of buying a car on lease

Leasing: A lease is defined as an agreement between a landlord (property owner) and a lessee (property user) whereby the former acquires property for the latter and permits him to use it in exchange for periodic payments called rent or minimum lease payments.

Advantages

- Balanced cash outflow (the biggest benefit of leasing is that cash outflows or hiring-related payments are spread over several years, saving the burden of a large one-time cash payment; this helps the business maintain a stable cash flow profile).

- Quality Assets (when leasing an asset, ownership of the asset still remains with the lessor while the lessee simply pays the costs; given this agreement, it becomes possible for the business to invest in good quality property that may otherwise look unaffordable or expensive) .

- More efficient use of capital (given that a company chooses to hire rather than invest in an asset through a purchase, it frees up capital for the business to fund its other needs or simply save money).

- Improved planning (leasing costs usually remain constant over the life of the asset or lease, or rise in line with inflation; this helps plan costs or cash outflows when budgeting).

- Low capital costs (leasing is ideal for a start-up business given that it means a lower initial cost and lower capital investment requirements).

- Termination rights (at the end of the lease term, the lessee has the right to buy back the property and terminate the lease agreement, thereby ensuring business flexibility).

Disadvantages

- Lease expenses (purchases are treated as an expense and not as an equity payment on the asset).

- Limited financial benefit (when paying money for a car, the business cannot benefit from any increase in the value of the car; a long-term lease also remains a burden on the business, since the contract is blocked and the costs for several years are fixed. In the case where the use of the asset does not satisfy needs after a few years, rent payments become a burden).

- Debt (Although hiring does not show up on the company's balance sheet, investors still view long-term leases as debt and adjust their valuation of the business to include leases.)

- Limited access to other loans (given that investors view long-term leases as debt, it can be difficult for a business to enter the capital markets and raise additional loans or other forms of debt from the market).

- Processing and documentation (in general, the conclusion of a lease agreement is a complex process and requires careful documentation and proper study of the subject of leasing).

- Maintenance of the property (the tenant remains responsible for the maintenance and proper operation of the rental property).

How to lease a car to an individual

In addition to the down payment, find out how much can you pay monthly for a lease agreement.

If the car you were driving in your dream costs an average of $20 more than your monthly maximum, then it probably doesn't make sense to go into debt to finance the car. So make a budget, stick to it, and figure out what options you have based on the money you have.

First discuss the final price purchases.

The leasing option you get for your vehicle will depend on the agreed purchase price. The lower the total price of the car, the lower the payment, even when renting. It's best to get this in writing first so the salesperson can't back off and try to scam you once you get down to the finer details.

Once the final purchase price has been agreed and set out in writing, discuss leasing terms. The higher your down payment, the lower your monthly payments will be.

Look at the lease agreement. Discuss your financial obligations for periodic maintenance and repairs. If you don't understand something, ask for a full explanation. After all, you sign a legal document and are responsible for what it says. Sign the lease document if everyone agrees.

Enjoy your beautiful, new car. Pay always on time and pay strict attention to the mileage clauses, otherwise it will change what happens when you return the car at the end of the lease.