How to save money on car rental insurance | report

Save money by buying car rental insurance instead of buying it from the pharmacy.

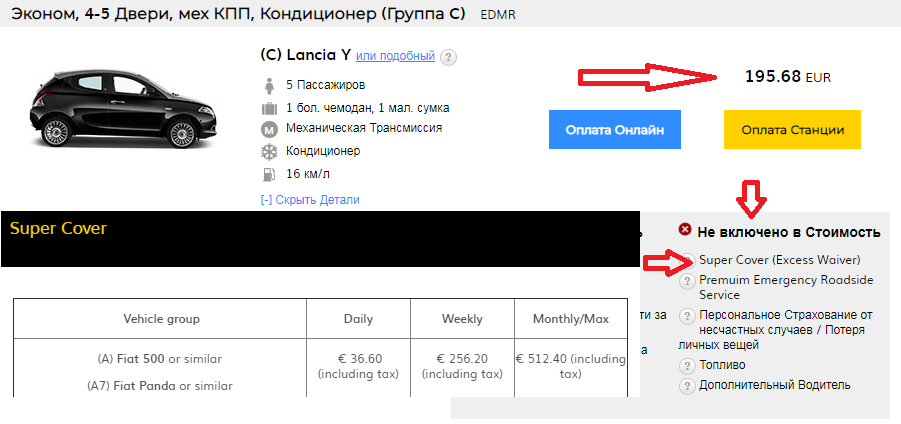

Car rental insurance can cost up to five times as much.

We've all been there - at the end of a long flight, you walk up to the car rental desk and amidst a pile of paperwork, you're confronted with a staggering array of insurance options.

From behind the counter, the assistant will try to sell you varying degrees of peace of mind.

However, that peace of mind could end up costing you five times as much as basic travel insurance, according to new consumer-watching CHOICE research.

Many car rental companies charge between $19 and $34 a day for insurance, while basic travel insurance can provide similar coverage for five days for $35, according to the report.

It has also been found that rental car insurance policies often contain exclusions for many common problems that can occur while driving, such as broken windshields and punctured tires.

Driving outside cities in Western Australia or the Northern Territory after sunset can also leave consumers uninsured, as can driving on unpaved roads or refueling with the wrong fuel.

CHOICE Head of Media Tom Godfrey advises consumers to consider all possible options when taking out rental car insurance.

“We all felt the need to get insurance when renting a car, but the reality is that if you take out travel insurance, you can save a lot of money by slamming the door,” he said.

“You can also save money by checking to see if you already have insurance coverage with your credit card, as some products include travel and car rental insurance. For example, ANZ Platinum cards include up to $5000 in deductible coverage for car rentals.”

Regardless of which insurance policy you choose, the watchdog advises "always read the terms and conditions and write down the exclusions."

CarsGuide does not operate under an Australian financial services license and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) for any of these recommendations. Any advice on this site is general in nature and does not take into account your goals, financial situation or needs. Please read them and the applicable Product Disclosure Statement before making a decision.