Châtel's right to terminate the insurance contract

Content

The Châtel Act, which came into force in 2008, aims to protect consumers and promote competition. It applies to tacit renewal insurance contracts and provides for termination periods to facilitate this. It requires organizations to send an expiration notice alerting consumers to an upcoming renewal of their contract.

🔍 Chatel's Law: how does it work?

La Shatel law makes it easier to terminate an insurance contract, be it car or home insurance, or mutual health insurance. It was created for protect the consumer. In fact, Chatel's law is the law for development of competition and therefore applies to both telephony and insurance service providers.

Chatel's law obliges you to be an organization give notice of termination your contract by tacit consent to terminate it at the end of the term. Specifically, this means that your insurer or supplier is obliged to remind you of the approaching termination date.

In this way, the Châtel law helps you terminate the contract on time and thus fosters competition, since this way you can take out insurance or mutual insurance elsewhere where you may be able to pay less.

Thus, Châtel's law is primarily aimed at service providers in the form of tacit renewal agreement : This includes telecommunications companies, your mutual health insurance, and your insurance, including car insurance.

The renewal of your insurance and your mutual insurance does happen automatically so that you don't end up without protection. But many consumers miss the termination date and remain insured in the same place by default.

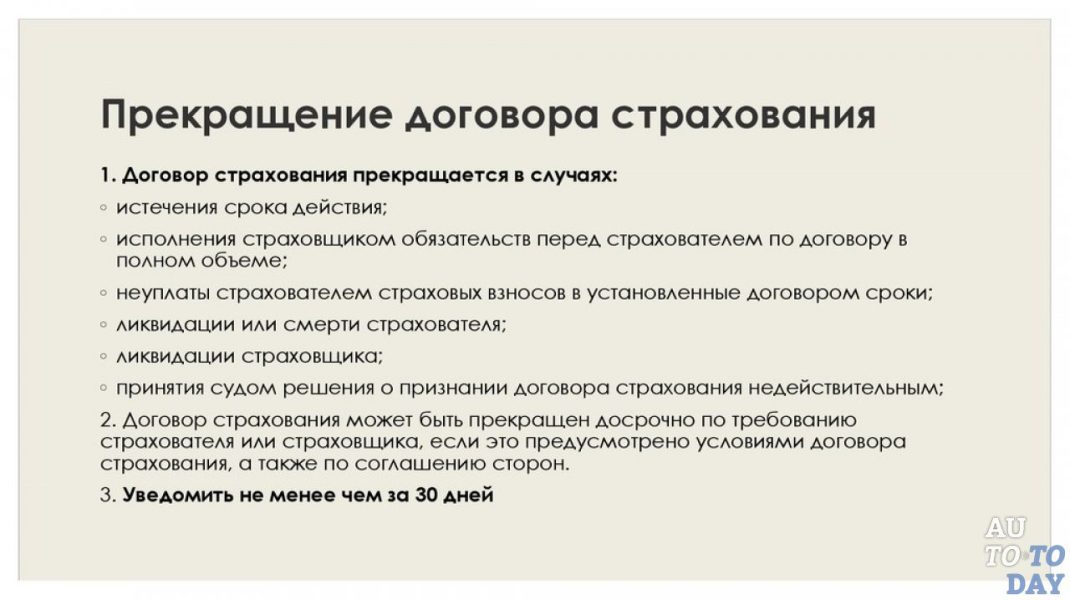

Thus, the purpose of Chatel's law is better inform these consumers... The term for termination of the contract must be revoked when the insurance organization sends a notice of the expiration of the contract. Chatel's law states:

- This date must be communicated to you at least 15 Days to;

- Otherwise, the termination date discarded.

When you receive proper notice and termination date, you will have 20 Days from dispatch to termination. If you do not receive them, you can cancel them at any time.

But not all contracts are subject to the Châtel law. Here are those who benefit from the termination of the Chatel law:

- Insurance contracts other than life insurance ;

- Implicit contract renewals ;

- Insurance contracts for individuals outside professional activity.

In short, the Châtel law does not apply to the termination of contracts that are not renewable by default, and also:

- Life insurance ;

- Group insurance ;

- Professional insurance ;

- Insurance of legal entities.

🗓️ What is the date of entry into force of the Châtel law?

Châtel's law, designed not to be caught off guard by the tacit renewal of his contract, and to facilitate termination, date 3 Janvier 2008... Parliament voted for him in December 2007. It was published in the Official Journal on January 4th and is effective. 1er June 2008... The official name of the Châtel law: Law No. 2008-3.

📝 How to terminate a contract under the Châtel law?

The Châtel Law governs the termination of your contract over time. To terminate a contract under the Châtel law, you must send a termination letter within 20 days from the date. sending your due notice. Send your mail by certified mail with receipt confirmation.

If you receive due notice less than 15 days until the end of the cancellation period you have an additional period 20 Days request termination. Finally, the Châtel law provides that if you have not received your contract anniversary notice, you can terminate it at any time.

The termination letter must include your name, address, date and number of your insurance contract so that the insurer can easily identify you.

Now you know that the text of the Châtel law provides for the termination of the tacit renewal of the contract. You can take advantage of this to make it easier to terminate your Car insurance if it doesn't suit you anymore. Don't let yourself be surprised by the renewal and let the competition play!