Termination of scooter insurance: how to proceed?

Content

Buying a scooter, like any other vehicle, requires insurance in order to be able to drive it on the road. Many people and professionals buy a scooter in the spring and decide to resell it after the summer season ends. Other people are planning to replace their old scooter with a new model. Termination of insurance can also be motivated by a change of insurer with lower rates. These are all the reasons why you should cancel your current insurance.

So how can you cancel your scooter insurance in the event of a sale? How can I terminate the insurance of a sold or given scooter? How to terminate scooter insurance for no reason? In this article, we will tell you how to stop insuring a scooter after it has been sold.

How can I cancel my scooter insurance after selling it?

When the opportunity arises and you feel the urge to sell your scooter, you have the opportunity to do so. But once the deal is done, she be sure to send a certified letter to your insurer... Although now more and more insurers are offering to do this through your client area. This letter must be accompanied by an acknowledgment of receipt and must be sent as soon as possible so that your insurance company is informed of the sale and can continue to terminate it.

You should be aware that if you sell a two-wheeled vehicle such as a scooter, you can terminate this contract free of charge. If your premium is paid annually, your insurance will reimburse you proportionally for the unused months. Here are all the conditions in the event of termination of the insurance contract in the event of a sale or transfer.

When should the insurance of the sold scooter be terminated?

After the sale of the scooter, you have the opportunity to terminate the contract without waiting for its expiration. You have this opportunity, even if your contract is not yet a year old.

Once you begin the termination process, all of your warranties will be suspended the day after the day of sale. The term for termination of the insurance contract after the sale of the scooter is three months. 10 days' notice must be followed.

Stopping the sale of a scooter: how to proceed?

If your scooter is sold, it is recommended that you send your insurance company a termination letter with confirmation of receipt. After this letter, your scooter insurance contract is completely terminated.

Your letter must be dated. This the date must be the day the scooter was sold and will correspond to the date of termination of the contract. Once the letter has been sent, your scooter insurance will expire in ten days.

After the sale of the scooter, the procedure to be taken to terminate the contract is to announce the sale to your insurance company. As we have already said, an advertisement for a sale is drawn up by registered mail sent to your insurer. Other information other than the date of sale must also be attached to the letter. You must also include your contact details, contract number and registration number of your scooter. In addition to all this, you must indicate the brand of your scooter.

Upon termination of the scooter insurance contract, you must also attach a copy of the cerfa form no. 13754 * 02 for the transfer declaration. Once the documents are received by your insurer, all of your guarantees will be automatically suspended the next day at midnight.

It is possible that your insurance and its guarantees are transferred to the new motorcycle when buying a new one... The transferred new contract may or may not be beneficial for your new scooter. Otherwise, your insurance will simply end automatically.

However, if you are selling your scooter to replace it with a new model or motorcycle, we recommend that you compare several offers from two wheeled vehicle insurers to save money and get the best possible warranties.

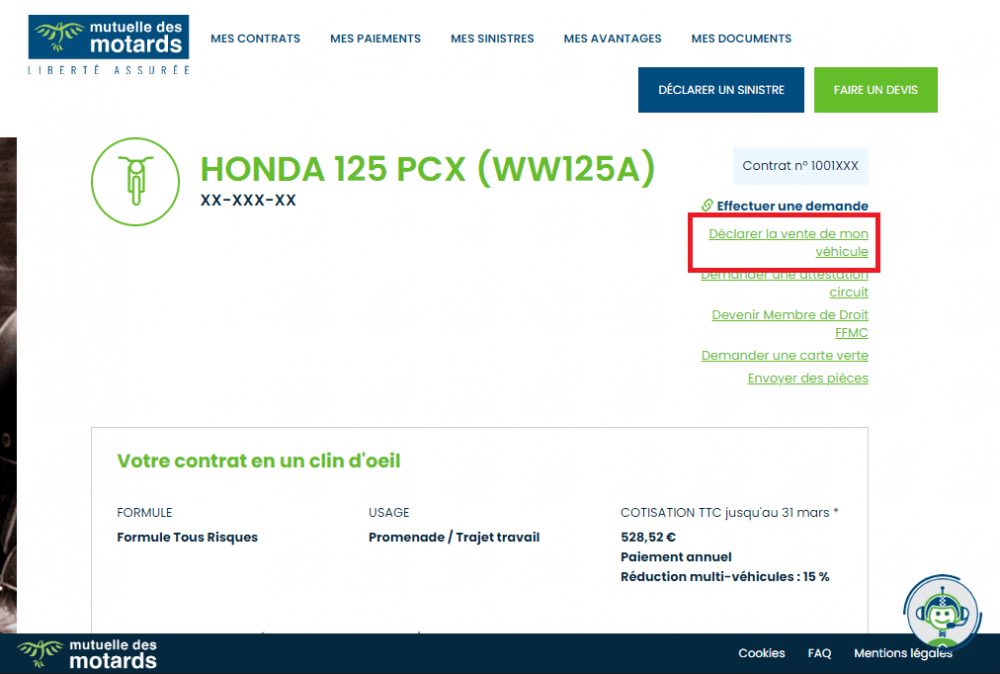

Here's how to declare the sale of your insured Mutuelle des Motards scooter to terminate your insurance. :

Refund of insurance premiums in proportion

When you send your cancellation letter to your insurer, you must do so with proof of receipt. As soon as the latter receives the letter, the insurance contract ends. If you have paid premiums for the period after the termination date, you receive a refund of the amounts paid on a pro rata basis... Indeed, the overpayment by the insurer will be paid to you.

To illustrate, let's say you paid for insurance for a whole month, and within a month you are required to sell your scooter. Your insurer must reimburse you for the remaining days of the month. These reimbursed amounts represent an overpayment due to you.

Proportional repayment is very important when your maturity has not yet expired during the year and you want to terminate your contract. Especially in the case of an annual payment.

Cancel your scooter insurance for no reason: what to do?

If your scooter is sold, it is very easy to terminate the contract. However, the process can be more complicated if you want to terminate the contract before it expires and for no reason to sell. Typically, you must then pay your insurer fines and fees. But there are certain provisions that allow you to carry out this operation without any restrictions: termination after the expiration of the contract (you just need to cancel) or during special provisions with the Hamon and Chatel laws.

Cancel insurance before the expiry of the Châtel law

To be able to terminate your insurance policy, you must know the various reasons for terminating your contract. First termination of the insurance contract can occur if your insurer does not comply with the Châtel law.

Cancellation of scooter insurance also occurs when scooter refuses to reduce your premium, increases your premiums, or changes (professional or personal) in your life. Of course, this agreement can also be changed for no reason, but on much less favorable terms. All these different provisions apply in the case of scooter insurance.

Termination or non-renewal of your insurance contract after its expiration

The first form of termination is termination after the expiration of your contract. If you don't want to make excuses, after the first year (anniversary date) of your contract, you can terminate an insurance contract.

To do this, you must send your insurer a letter of termination with notification of receipt. The letter must be sent two months before the end of your contract. The insurer's role is to tell you the end date of your contract fifteen days in advance. Thus, you have twenty days to announce the termination of the contract.

In case you do not react before the expiration of your insurance contract, it will simply be repeated automatically and silently. Therefore it is appropriate be responsive as soon as you get the deadline for the onset of a new period.

Cancel insurance before Jamon's law expires

In some cases, you can terminate your contract before it expires. V jamon-based, you can terminate it one year after the conclusion of the insurance contract without any reason for the sale or otherwise.

This law will be beneficial to you if the premiums requested by your insurer increase, if your personal or professional situation changes, if you sell your scooter or if you lose it.

The Hamon Act also allows you to terminate a future sale if the latter is already one year old. If you wish to terminate the contract, you will not be fined one year after the conclusion of the insurance contract. You can send your insurer a simple letter or email.

However, it is you it is recommended to send a certified letter with a receipt notification... Your contract will be terminated in just one month. You will also receive compensation for the premiums overpaid by the insurer.