Is it worth buying a car with a deposit?

Content

Buying a new car is a losing proposition. “But wait,” you say. “Look at all the bells and whistles that this car has. It's worth every dollar." According to Edmunds, after the first mile of ownership, your car has already lost…

Buying a new car is a losing proposition. “But wait,” you say. “Look at all the bells and whistles that this car has. It's worth every dollar."

According to Edmunds, after the first kilometer of ownership, your car has already lost nine percent of its true market value. Think it's bad? In the first three years, your "new" car will lose 42% of its original true market value.

If cars were available, no one would buy them.

Is it profitable to buy a used car?

You may come to the conclusion that buying a car is a bad idea. It shouldn't be. Since most of a car's depreciation occurs in the first three years, it makes sense to look at used cars that have already absorbed most of their depreciation.

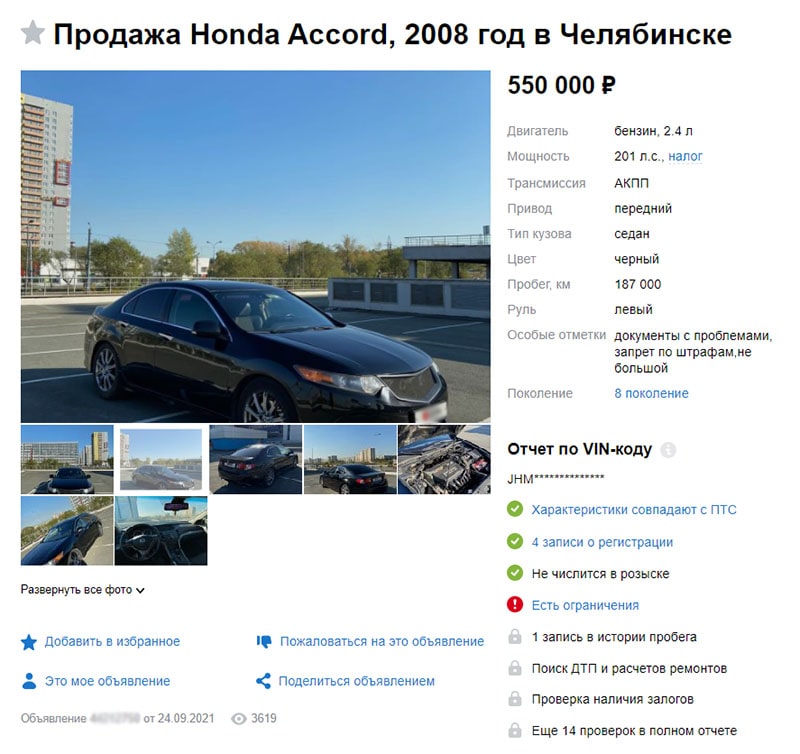

Okay, let's say you spend some time looking for a used car online. You find the one you like, check it out and decide to buy. The deal looks like a win-win, doesn't it? Until the owner throws the ball at you. He tells you that the car is in collateral.

What is a pledge?

A lien is the right of a third party (such as a bank or individual) to claim ownership of a car until the loan is repaid. If you have ever bought and financed a car through a dealership, the lender held a lien against your car.

If you are buying a used car from a dealer or used car lot, your transaction will be easy. The original financier will be paid and the dealer will hold the title. If you finance the purchase, the bank will hold a lien. If you pay in cash, you will own the title and there will be no deposit.

Visit the DMV website for retention information

Things change a bit when you buy a car from a private individual. Before concluding a contract, you should start checking the history of the car. DMV has an extensive website and can provide you with information on ownership.

If you find that the seller still owes money for the car, buying it is usually not much of a problem. The buyer writes a check for the amount owed to the bond holder and mails it to the company holding the bond. It may take a few weeks for the title to be sent to the seller.

When does the buyer become the official owner of the car?

This is where the transaction gets a little more complicated. In the interim, the seller will retain ownership of the vehicle until ownership is obtained. In the meantime, the buyer has sent money to pay off the deposit, and he's not sure what's going on with his car. Is the owner still driving? What if he gets into an accident?

The buyer cannot legally drive or insure it without title, so buying a car with a lien becomes a difficult task.

To close the deal, the seller must obtain ownership of the car from the lien holder in order to transfer ownership, and the buyer needs a signed title deed to register the car.

You don't have to give the seller money to pay off the bond holder. People can have money problems — they forget to send it, they need a new pair of skis, etc. — so if you hand over a few thousand in cash, you may never see the salesperson or your car again.

Not all liens are listed by the DMV

In addition, there are liens that may or may not appear when searching for vehicles.

Property such as cars can be subject to liens that you will never know about. If the seller is in arrears in taxes due to the IRS or the state government, the vehicle may be seized. Buyers are protected to some extent by IRS Code 6323(b)(2), which "prevents tax liens from interfering with the sale of your vehicle unless the buyer was notified or aware of the tax lien at the time of purchase."

If your seller knows about the federal tax lien when he sells the car and discloses that information to you, it might be wise to leave because you could be in a three-way fight with the IRS, the seller, and you.

Failure to pay child support can lead to arrest

The Family Court can also seize the car if the seller doesn't pay child support. Some, but not all, states follow some variation of this process: the state department of social services or the department responsible for child support places a bond on a vehicle owned by the defaulting parent.

The department of social services or the department responsible for child support sends a letter to the bail holder instructing them to return the forfeited title to the court or destroy it. The court then issues a new title and lists itself as the bondholder.

Spending money on a car is not the smartest investment, but almost all of us need it. If you are not buying a classic car as an investment, you are guaranteed to lose money.

Rationale for considering a used car

Buying a used car is more profitable from a financial point of view. Almost half of the depreciation has been written off; if you buy a car from a dealer, any car you choose will most likely be in near-new condition; and it probably still has an extended warranty just in case something major goes wrong.

The decision to buy a used car from a private individual is probably not difficult. It is true that if you buy a late model car, you will have a lien. Companies that finance cars are constantly involved in private sales. Everything will probably go smoothly.

However, there are mortgage holders that you may not even know about who have cash on the car. Do your homework, listen carefully to a salesperson who may talk about a child support refund or IRS prosecution.

His impromptu remarks, which have nothing to do with the sale, can tell you everything you need to know about the deal.

If you have any doubts about the quality of the purchased car, you can always call a certified AvtoTachki specialist to inspect your car before buying. This will allow you not to worry about finding out the true condition of the car before the final purchase.