Is it worth buying a car under the First Car and Family Car programs?

In July last year, targeted state programs of preferential car loans "First Car" and "Family Car" were launched in Russia. “Wow, a discount!” exclaimed the citizens and rushed to storm the car dealerships in order to leave them without salty slurping in most cases. Why it turned out to be not so profitable to buy cars with the support of the state, the AvtoVzglyad portal found out.

Russian people love "freebies" - this is an indisputable fact. And if buying a new car for 1 rubles seems like an unaffordable luxury for many, then the price tag of 400 rubles seems to untie their hands and wallets. Blinded by the unprecedented generosity of the authorities, motorists are in a hurry to snatch their discount, completely forgetting that free cheese is only found in a mousetrap. But even state support programs have several pitfalls that buyers should be aware of.

But first things first. According to the terms of state programs, benefits for the "first" and "family" cars are provided to those who buy a car for the first time, as well as families raising at least two minor children. In other words, you can count on a 10% discount if no car has been previously registered for you, or if you are raising two or more children whose age does not exceed 18 years.

Alas, the new Jaguar XJ, whose price tag slightly exceeds 6 million rubles, will not be thrown off 600. Models worth no more than 000 "wooden" strictly fall under the programs. In addition, the machine must be produced in Russia. So saving money on, say, a Mazda1 supplied to our country from abroad will also fail. And also remember that in addition to the price list and the place of "registration", the release date is also important - only 450. I think it's unnecessary to remind that benefits are given exclusively for new cars.

“Here it is, my chance to buy the coveted KIA Rio at a super low price!” You think. But what to do next? It's simple: after you make sure that the car meets all the criteria, you need to find out if the manufacturer participates in these programs. You can call the hotline of the Russian representative office of the brand or any specific dealer. Better - immediately to the dealership.

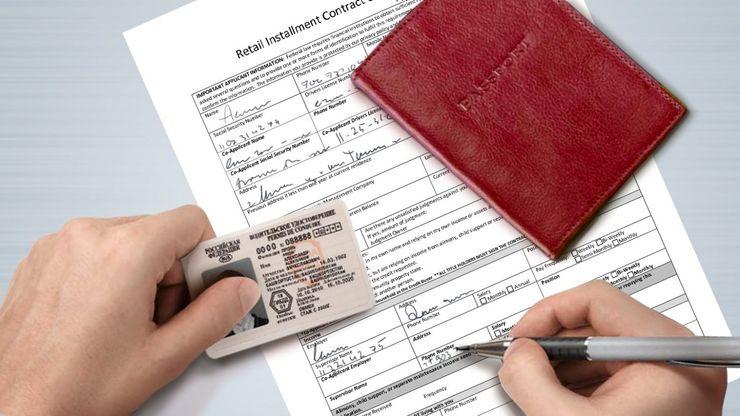

Having decided on a specific car, having learned from the seller its final cost with all dealer discounts and additional equipment, contact the insurance and credit department. Tell the cute girls that you want to use the "First Car" or "Family Car" program. For the most part, they are familiar with the conditions for the provision of subsidies, and therefore it will not be difficult for them to calculate how much, taking into account the benefits, the vehicle will cost you.

And now attention! Yes, in fact, such attractive state programs imply a 10% discount on the total cost of the car. But it is achieved not by direct "cutting" the price tag, but by credit relief. Credit! In any case, you will have to borrow a certain amount. How much exactly - check with that very pretty employee of the department. Each dealer or bank has different conditions - one car dealership will require you to borrow 150 rubles, the other - all 000.

The main problem is that when applying for a car loan, dealers impose on customers an extended CASCO that protects almost from alien invasion, as well as insurance against accidental death, job loss and a broken toe. That is, they add thousands more to your check, like a hundred. It turns out that the subsidy honestly allocated by the state goes not to repay the principal debt, but to additional and unnecessary services for someone.

So before signing up for a “heavy” car loan, seasoned with sweet “First Car” or “Family Car” sauces, calculate everything properly and more than once. Already calculated? Do it again! In general, if you don’t have enough a couple of hundred thousand for the desired car, it’s more profitable to take not a car loan in the dealer’s salon, but a loan for personal needs at the bank – the latter’s interest is much more humane.

However, if you have come to the conclusion that state programs will still save your wallet, despite fees in the form of additional services, hurry up! Last year, quotas ended before motorists knew about the existence of subsidies - a ten percent discount was handed out for only two to three months. And given last year's experience, we can assume that the current "First Car" and "Family Car" are unlikely to "live" even until the summer.