Inflation in the US: How the prices of new, used cars, accessories and repairs have risen over the past year

Content

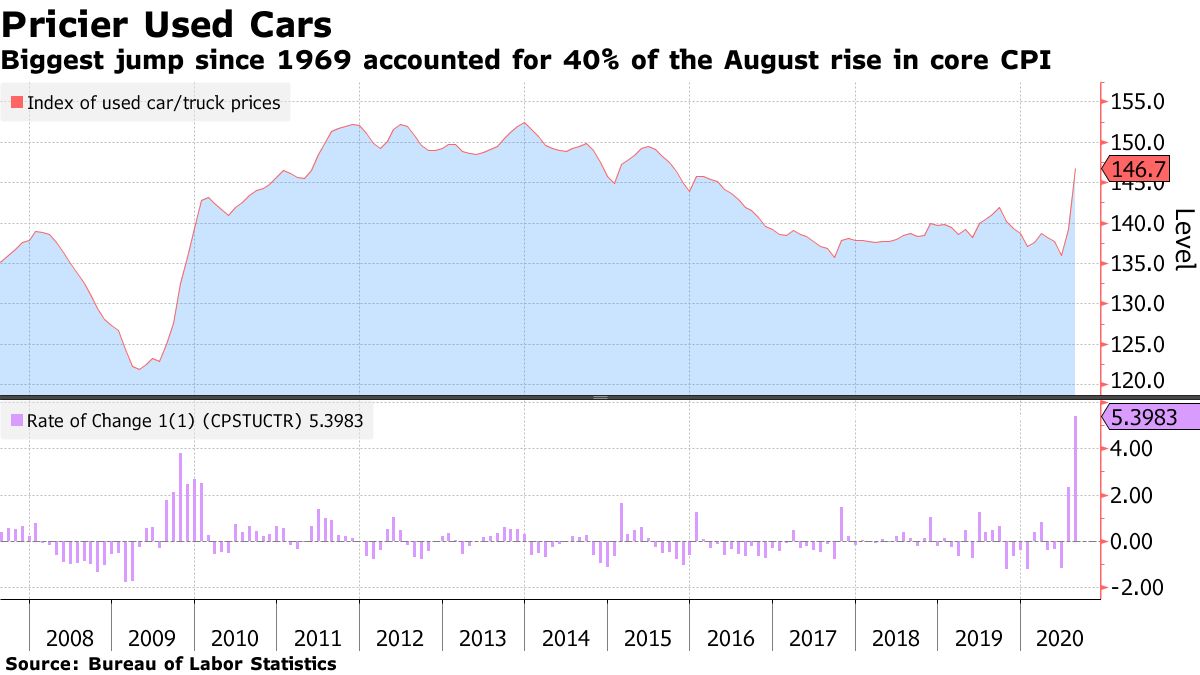

Inflation has proven to be one of the most devastating features of the economy since the arrival of the covid infection, which has put the White House and the Federal Reserve to the test. This raised the cost of used cars, limited new car production due to component shortages, and affected waiting times for car repairs.

Prices rose 8.5% in March year-over-year, the biggest annual increase since December 1981. This has had a great impact on the American economy and has affected various sectors, one of which is the automotive sector, which has experienced growth in various areas such as gasoline prices, new cars and used cars, even in the production of components and auto repair. .

According to the U.S. Bureau of Labor Statistics, the automotive sector saw annual growth from March 2021 to March 2022:

fuel

- Motor fuel: 48.2%

- Gasoline (All types): 48.0%

- Regular unleaded gasoline: 48.8%

- Medium grade unleaded gasoline: 45.7%

- Premium unleaded gasoline: 42.4%

- Other motor fuel: 56.5%

- New cars: 12.5%

- New cars and trucks: 12.6%

- New trucks: 12.5%

- Used cars and trucks: 35.3%

- Auto parts and equipment: 14.2%

- Tires: 16.4%

- Vehicle accessories other than tires: 10.5%

- Auto parts and equipment other than tires: 8.6%

- Engine oil, coolant and fluids: 11.5%

- Transport services: 7.7%

- Car and truck rental: 23.4%

- Vehicle maintenance and repair: 4.9%

- Car body work: 12.4%

- Service and maintenance of motor vehicles: 3.6%

- Car repair: 5.5%

- Motor vehicle insurance: 4.2%

- Car rates: 1.3%

- State vehicle license and registration fees: 0.5%

- Parking and other fees: 2.1%

- Parking fee and fees: 3.0%

Automobiles, parts and accessories

Transport and documents for the car

Economic slowdown expected this year

The White House and the Federal Reserve have launched several initiatives to try to control inflation, but rising prices for gasoline, food and a host of other products continue to affect millions of Americans. The economy is now expected to grow at a slower pace later this year, in part because inflation is forcing households and businesses to weigh whether to cut back on purchases to protect their budget.

Inflation data released on Tuesday by the Bureau of Labor Statistics showed prices rose 1.2% in March from February. Bills, housing and food were the biggest contributors to inflation, underscoring how inevitable these costs had become.

Semiconductor chips and auto parts

Inflation has been relatively constant, even low, for most of the last decade, but has risen markedly as the global economy has emerged from the pandemic. Some economists and lawmakers believed that inflation would ease this year as supply chain problems cleared up and government stimulus measures faded. But the Russian invasion of Ukraine in February sparked a new bout of uncertainty and pushed prices even further.

Semiconductor chips are back in short supply, leading to production halts by various automakers, who have even started stocking them at dealerships with the promise of installing them later, thereby fulfilling their delivery plans to customers.

Repairs in service shops were also affected, as delivery times were highly dependent on spare parts or components, and since such parts were in short supply, they became more expensive due to high demand, as a result of which the customer economy would be even more unbalanced and leading their vehicles to stop for a longer time.

How have gas prices changed?

Attempts to isolate Russia have also had repercussions for the global economy, jeopardizing supplies of oil, wheat and other commodities.

Russia is one of the world's largest oil producers, and its invasion of Ukraine has prompted the US government and other countries to try to limit Russia's ability to sell energy. These movements increased energy expenditure; Crude oil soared to new highs last month and a rise in gasoline prices quickly followed.

. The Biden administration announced Tuesday that the Environmental Protection Agency is moving to allow the sale of blended gasoline in the summer to boost supply, although the exact consequences of that are unclear. Only 2,300 of the 150,000 gas stations in the country offer E gasoline will be affected.

The March inflation report showed just how badly the energy sector has been hit. Overall, the energy index increased by 32.0% compared to last year. The gasoline index rose 18.3% in March after rising 6.6% in February. Even as oil prices decline, the impact of the gas station label continues to weigh on people's wallets and detract from their perception of the economy as a whole.

Just a few months ago, White House and Federal Reserve officials were expecting inflation to start declining from the previous month. But those predictions were quickly dashed by the Russian invasion, the Covid shutdown at major Chinese manufacturing centers, and the sad reality that inflation continues to seep through every crack in the economy.

What about the prices of used cars, new cars, and the scarcity of semiconductor chips?

Nevertheless, the March inflation report gave some optimism. Prices for new and used cars are putting a damper on inflation as global semiconductor shortages collide with staggering consumer demand. But .

While gasoline surges have historically encouraged buyers to switch to more economical options, the pandemic-induced shortages of materials and semiconductors have severely limited the supply of new cars. Car prices are also at record levels, so even if you find something you want to buy, you'll pay a lot more for it.

The average cost of a new car rose to $46,085 in February, and as Jessica Caldwell, chief information officer at Edmunds, noted in an email, today's electric vehicles tend to be more expensive options. As Edmunds points out, if you can find it, the average transaction price for a new electric vehicle in February was a dollar (though it's unclear how tax breaks affect that figure).

Fears of a further economic downturn

Inflation has proven to be one of the most devastating features of the recovery from the pandemic, taking a heavy toll on households across the country. Rents are rising, groceries are becoming more expensive, and wages are rapidly declining for families just trying to cover the bare necessities. Worst of all, there is no quick respite in sight. New York Federal Reserve survey data showed that in March 2022, US consumers expected inflation to be 6,6% over the next 12 months, compared to 6.0% in February. This is the highest since the start of the survey in 2013 and a sharp jump from month to month.

**********

: