How to apply for OSAGO - where is it better to make a compulsory insurance policy

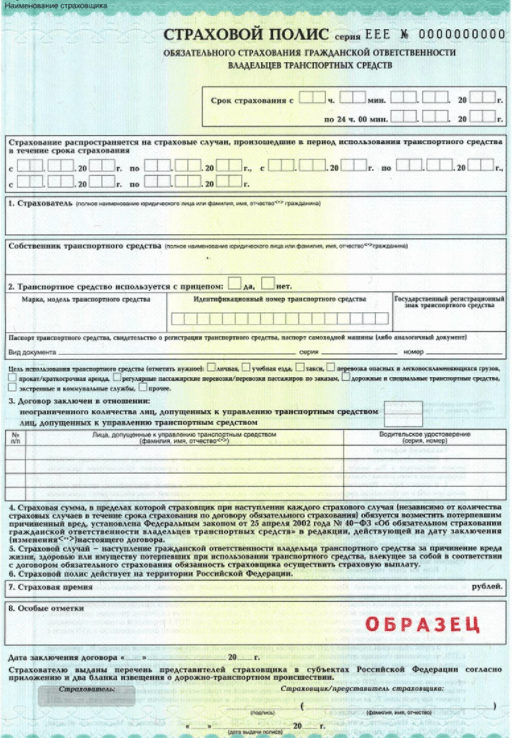

An OSAGO insurance policy is issued by any person who has the right to drive a vehicle. OSAGO is a compulsory civil liability insurance, with its help it is possible to compensate for damage that is caused to the property and health of other persons.

The following documents are provided for registration of OSAGO:

- application to the insurance company;

- passport;

- vehicle passport and certificate of registration of the vehicle with the traffic police;

- driver's license and copies of the VU of all those persons who are planned to be entered in the OSAGO;

- certificate of ownership of the vehicle;

- TO ticket.

Many insurance companies provide OSAGO registration services. You do not even need to bring all of the above documents to the company's office, you just need to send scans or high-quality digital photographs by e-mail, and all applications and forms will be filled out for you. In this case, you will only need to put your signature on the forms of documents. Documents for signing, the policy itself, as well as a payment receipt can be delivered by courier directly to your home.

OSAGO is concluded for a period of 12 months, it is possible to issue it for six months if you do not plan to use the car in winter. The cost of a semi-annual policy will be 60-70 percent of the cost of a one-year one.

The cost of OSAGO is the same in any region of the country and in any insurance company, it consists of a basic tariff - approximately 2 thousand rubles and various coefficients:

- engine power;

- purpose of using the vehicle;

- region;

- on the number of persons included in the policy, their age and driving experience;

- on the number of insured events in the past;

- from the age of the vehicle.

You can calculate the cost of the policy using an online calculator. So, if you are the owner of a car with an engine power of no more than 150 hp, your driving experience is at least 3 years, you live in Moscow and use the car exclusively for your own needs, then you will need to pay for the policy (if you issue him for the first time) only 5500 thousand. Repeated registrations will cost even less, but only if you did not have insurance cases and gross violations of traffic rules.

The maximum amount of compensation for OSAGO is 400 thousand rubles. To receive a refund, you must provide:

- certificate of the accident and a copy of the protocol;

- medical report on damage to health;

- receipts for payment for the treatment of victims;

- expert opinion on the amount of damage caused.

The insurance company has 30 days to make a decision. If the amount is not enough, then you can issue an additional policy of voluntary insurance DSAGO.

Loading…