How to calculate transport tax on a car in 2014

Every citizen of Russia who owns a car is obliged to pay transport tax once a year. These funds are paid to the local budget and used at the discretion of the regional administration. The tax code does not specifically state where this money goes, although, logically, it should be used to repair and maintain roads. You can talk about Russian roads for a long time, but first let's try to deal with the question - how to calculate the transport tax.

This tax is calculated according to a simple scheme:

- the tax rate is multiplied by the percentage of ownership in the year (1/12 - 1 month, 5/12 - 5 months, 12/12 - all year round)

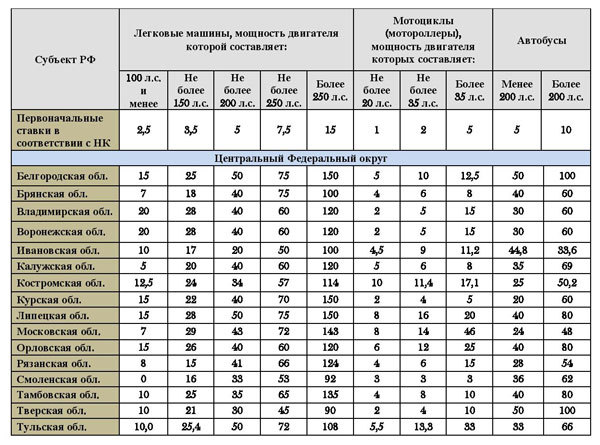

What is the vehicle tax rate? This is an all-Russian coefficient, which depends on the power of the car's engine. So, for cars up to 100 hp. the rate will be 2,5 rubles, for cars 100-150 hp. - 3,5 rubles, for cars with a power of over 250 hp. - 15 rubles. However, there is one "but" - any region has the right to establish an economically justified rate, which will not exceed the all-Russian rate by more than 10 times.

To calculate this coefficient for your car, you need to find the rates that are approved in your federal subject. For example, the owner of a compact hatchback (up to 100 hp) registered in Moscow calculates the tax based on the rate of 12 rubles per horsepower, in the Penza region the owner of the same hatchback will already pay 14 rubles per horsepower.

Thus, we get the following picture for a resident of Moscow who owns a Hyundai i10 with an engine power of 65 hp:

- 65 HP multiply by 12. and divide by 1 if the car was registered for the owner for all 12 months - it comes out 780 rubles;

- if the car was in use for six months, then we get - 65 * 12 / (12/6) = 390.

As you can see, 780 rubles for Moscow is an insignificant amount, though the Hyundai i10 is not the best and, moreover, not the most powerful car. But the owner of a Premium class car with a powerful engine will have to fork out. Mercedes SLS AMG - the engine power of this supercar is 571 hp, and the tax rate for such cars in Moscow is 150 rubles. For a full year of owning such a car, the owner will have to pay - 85650 rubles.

It is worth saying that for such powerful cars there cannot be a rate higher than 150 rubles, but the rates for engines of a lower class differ significantly. For example, in St. Petersburg, the owner of the same Hyundai i10 will multiply 65 hp not by 15 rubles, but by 24, and he will have to pay not 780, but 1560 rubles. In Yakutia, the rate is 8 rubles, and for luxury cars - 60 rubles. In a word, all these rates can be found in your regional tax office.

Separately, rates are indicated for other categories of vehicles - motorcycles, buses, trucks, semi-trailers, tractors. Owners of yachts, boats, helicopters and airplanes pay transport taxes.

There is also a wide list of categories of citizens and legal entities that are completely exempt from mandatory payments: the liquidators of the Chernobyl accident, the disabled, orphans, and so on. Passenger transportation companies are exempt from tax.

The tax must be paid after receipt of the receipt. Each region independently indicates the deadlines for payments, as a rule, this is February - April, but no later than November of the next year. That is, a resident of Moscow will have to pay tax for 2014 no later than December 2015, XNUMX.

Well, the most interesting question - penalty for non-payment. The fine is small - it is a fifth of the unpaid funds. Also, every day there is a penalty - 1/300 of the annual percentage

(it is difficult for a person without special education to deal with this, but all these amounts are indicated on the receipt, and you can figure it out in the inspection or with a familiar lawyer).

If it seems to you that the numbers on the receipt are too high, the tax office must explain everything clearly and clearly.

Loading…