The car was sold, and the tax comes

However, such incidents quite often occur when the former owners receive a tax notice about the payment of tax. Moreover, quite often there are situations when notifications about payment of traffic police fines will be sent to your name. What could be the reason for this and how to avoid such incidents?

Why are notifications coming?

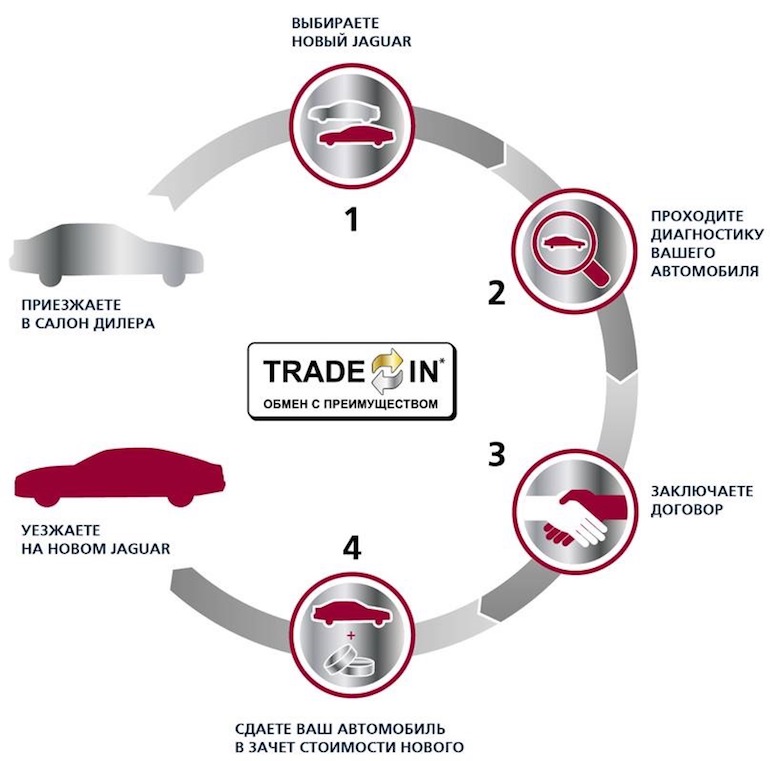

According to the new regulation, the process of buying and selling used cars takes place without removing the car from the register. That is, it is enough to draw up a DKP (purchase and sale agreement) according to all the rules, agree on the issue of paying the full price (pay immediately or in installments), receive the keys, TCP and a diagnostic card from the former owner. Then you need to take out OSAGO insurance. With all these documents, you need to go to the MREO, where you will be issued a new certificate of registration. You can also order new license plates or leave the car on the old numbers.

A notification is sent from the traffic police to the tax office that the owner of the vehicle has changed and now he will pay the transport tax. But sometimes the system fails, which is why such unpleasant situations occur. There may be several reasons:

- the new owner did not re-register the car for himself;

- the traffic police did not send information about the change of ownership to the tax office;

- something messed up in the tax authorities themselves.

You should also not forget that the former owner will still receive a receipt with a transport tax for the months when he used the car. That is, if you sold the car in July or November, you will have to pay for 7 or 11 months, respectively. If you see that the amount is less than usual, then you should not worry too much, since you simply pay for these few months.

What should I do if I have been taxed on a car sold?

Any lawyer will advise you to take your copy of the sales contract and go with it to the traffic police department, where you will be given a certificate that this vehicle has been sold and you no longer have anything to do with it.

Next, with this certificate, you need to go to the tax authority from which you were sent a tax notice, and write a statement addressed to the head of the inspectorate that, according to the DCT, you are not the owner of this car, since it was re-registered to another owner. A copy of the certificate from the traffic police must be attached to the application.

The traffic police, MREO and tax, it must be said, are those bodies that are famous for their attitude towards ordinary representatives of the people. Therefore, it is not surprising that sometimes, in order to carry out such a simple operation as obtaining a certificate and submitting an application, one has to spend one's precious time knocking around thresholds and standing in queues. Pleasant little. Moreover, the editors of Vodi.su are aware of cases when, even after writing all the statements, taxes were still charged. What to do in this case?

First of all, you need to make sure that your buyer really re-registered the car for himself. The fact of re-registration must be confirmed by the MREO. In this case, you can simply not pay the tax, but when you receive a subpoena, show all the documents at the court, as well as a note that you filed a corresponding application with the tax authorities. Agree that it's not your problem if they can't clean up the paperwork.

Of course, this method is extreme, but a busy person often has no time to run around different authorities on the same issue. We can advise another way - register on the website of the Federal Tax Service, create a personal account and monitor how taxes are calculated for you. To register, you must obtain a personal registration card from the nearest FTS authority, regardless of your place of permanent residence. The personal account provides the following options:

- receive up-to-date information on objects of taxation;

- print notifications;

- pay bills online.

Here you can solve all the questions that arise. Registration is available to individuals and legal entities.

The new owner did not register the car with the traffic police

It may also turn out that the buyer did not register the car. In this case, the issues need to be resolved personally with him. If the person is adequate, you can control the process of registering the car, as well as give him notifications from the Federal Tax Service so that he pays the receipts.

You will have to worry if communication with a person is lost or he refuses to fulfill his obligations under the contract. In this case, the law provides for several options for solving the problem:

- filing a lawsuit in court;

- writing an application to the traffic police on the search or disposal of the car;

- rupture of the DKP unilaterally.

As a result of the trial, in the presence of all correctly executed documents on the sale, it will not be difficult to prove the guilt of the defendant. He will be obliged to pay not only taxes or fines, but also your costs for conducting the process. The search, disposal of the sold vehicle or breaking the DCT are already more stringent methods, but there will be no other way out. Please note that if the DCT is broken, you will need to return all the funds received for the sale of the car, minus your costs for paying taxes, fines, legal costs, and depreciation of the vehicle.

Tax refund

If you, as an exemplary taxpayer, paid taxes for the sold car, but then the issue with the new owner was resolved positively, the money spent can be returned. To do this, you must perform the following operations:

- get a certificate of re-registration of the vehicle from the traffic police;

- contact the Federal Tax Service with this certificate and the corresponding application.

If there is no desire to run around the offices and corridors, negotiate with the new owner. Fortunately, the amount of transport tax for cars with engine power up to 100 hp. even in Moscow, they are not the highest - about 1200 rubles a year.

Loading…