Sold the car - do I need to file a declaration? Declaration when selling a car

The state apparatus vigilantly monitors all financial transactions of the accountable population. Citizens are required to pay taxes on all their income. It does not matter whether you are a private entrepreneur, the head of a large company or a simple hard worker. Everyone must pay taxes.

Responsibility for tax evasion

Remember that non-payment of taxes is subject to tax liability. For committing a tax offense, a person is subject to fines and increasing penalties. Responsibility is described in detail in article 119 of the Tax Code of the Russian Federation:

- a fine of 1000 rubles for failure to file a zero declaration;

- a fine of five to twenty percent of the tax amount, depending on the date on which the income was received;

- a penalty on income tax in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay if the declaration was not submitted before July 15.07 of the current year.

In addition, if large amounts are involved, for example, for non-payment of tax on the sale of a VIP-class car, criminal liability may follow under Article 198 of the Criminal Code of the Russian Federation - a fine of up to 4,5 million rubles, or imprisonment of up to one year.

As you can see, joking with the FTS is dangerous. Fortunately, not everyone is required to pay taxes and file declarations for the sale of a car. Let's consider this issue in more detail.

Filing a declaration for the sale of a car

We can first of all please those motorists who have owned their vehicles for more than three years. The Tax Code of the Russian Federation (Art. 217 and Art. 229) states that after the sale of vehicles, they are completely exempt from the obligation to file a declaration and pay any taxes to the state treasury. This applies to both purchased vehicles and those inherited or donated.

Those citizens who owned the car for less than three years should report.

They are obliged:

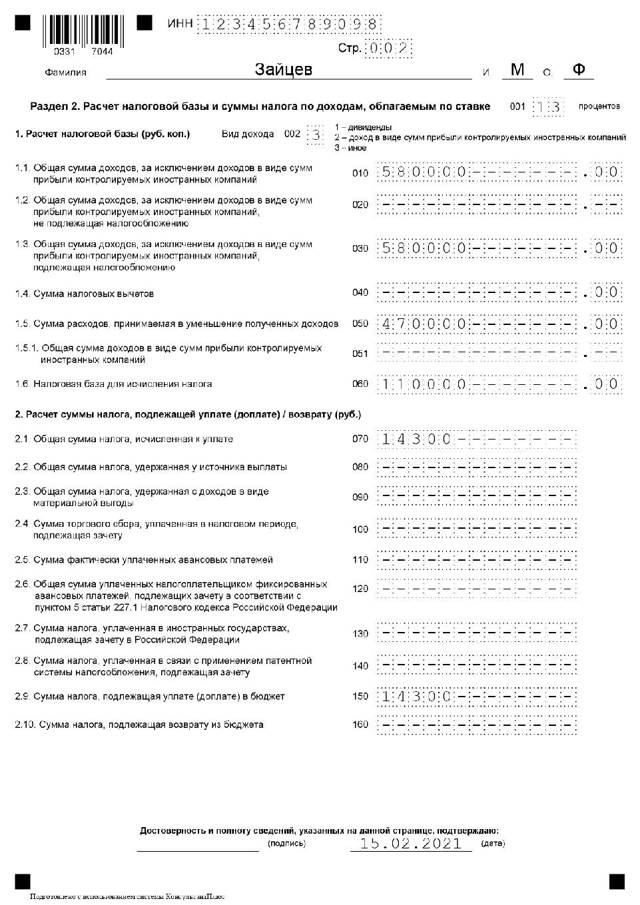

- correctly fill out and submit the declaration 3-NDFL;

- pay 13% tax on your income.

Pay attention to the key point: the declaration is submitted without fail. But money is not always paid, since it is not the amount for which you sold the car that is taken into account, but the difference between the price of the car at the time you bought it and the price at the time of sale. That is, if a car was bought for 1 million rubles, and sold for 800 thousand, then there will be no income, respectively, nothing needs to be paid to the treasury of the state. But the 3-NDFL declaration will still have to be submitted.

To file a declaration, you must bring with you to the local authority of the Federal Tax Service:

- personal passport;

- contract of sale;

- documents confirming the fact that you purchased this vehicle.

Based on the data provided (purchase and sale agreements), an employee of the Federal Tax Service will be able to calculate the amount that needs to be paid in the form of tax. It is very important to keep the original contract of sale, because in the absence of it, you will not be able to confirm the fact that you purchased the car at any given price. Fortunately, a copy can be requested from the registration department of MREO.

How to reduce the amount of tax?

First of all, in order to pay nothing at all, do not sell a new car. Wait at least three years from the date of purchase. If the deadlines are running out, then you can take advantage of tax deductions in the amount of 250 thousand rubles.

The tax deduction in the amount for the year cannot exceed 250 thousand. The vodi.su portal draws your attention to an important point, for those who sell cars cheaper than they bought, there is no point in using it, since they still do not need to pay anything to the Federal Tax Service. But there are other situations as well.

Here is an example:

The citizen inherited two cars, which he sold for 500 thousand each. His net income is 1 million rubles, of which 13 percent, that is, 130 thousand, would have to be given to the state. But thanks to the tax deduction, the tax will be calculated according to a different scheme. 1 million minus 250 thousand. Accordingly, you will have to pay approximately 97 thousand.

Deadlines for filing a declaration

If you inherited a car or bought it less than three years ago and subsequently sold it, you must submit the data to the tax office strictly on time, otherwise you will face penalties.

Individuals report their income.

Submission deadlines:

- the completed form 3-NDFL is submitted no later than April 30 of the next year (if the car was sold after this date);

- Payments must be made no later than July 15 of the following year.

Filling out the form is a simple process, but everything must be written correctly, so even errors can be penalized. There are programs and applications on the web to help complete this reporting document.

It is worth noting that the form of the declaration undergoes changes every year. For 2017, you can use the form approved last year. Declarations of 2017 will be used to submit income data in the upcoming 2018.

Loading…