Tax on the sale of a car owned for less than 3 years and more than three years

Any car owner eventually thinks about how to sell his old car and buy something newer and more modern. The sale of a used car according to the Tax Code, Article 208, is considered to be additional income, and citizens must report on all their income to the state and pay interest to it.

What does a person who is going to sell a car need to know?

Taxes are required to pay not only individuals and legal entities, any person must pay tax on their additional income. That is, if you work for someone and receive a salary officially, then you do not need to pay tax, since all taxes from your salary have already been paid.

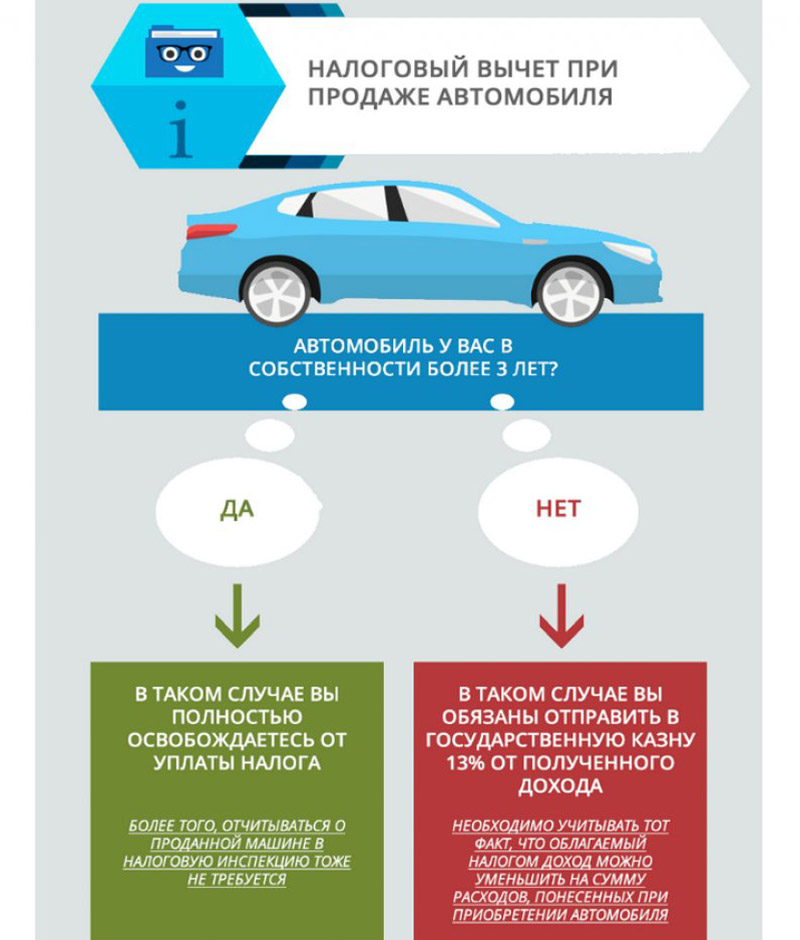

Tax on the sale of a car is paid in the following cases:

- if you have owned a car for less than three calendar years - 36 months;

- if the value of the vehicle exceeds 250 thousand rubles.

You do not need to pay taxes in the following cases:

- the car has been owned by you for more than thirty-six calendar months;

- costs less than 250 thousand;

- The car is sold under a general power of attorney.

Also in the Tax Code there are some points that allow you to significantly reduce the amount of tax, or not pay it at all.

First of all, it must be said that the tax on the sale of a car is 13 percent.

Those citizens who sell a car no more than once a year can take advantage of a tax deduction, at the moment it is 250 thousand rubles.

Let's take an example for clarity:

You want to sell a car for 800 thousand rubles. The tax is calculated as follows: 800 - 250 = 550 thousand - that is, 13 percent must be paid from 550 thousand, which will amount to 71500 rubles.

In addition to the tax deduction, there is another mechanism for reducing mandatory payments to the state. If the owner can confirm the original price for which he once bought the car, then the tax will be paid only on the difference - the owner's earnings:

- bought a car at one time was for 500 thousand;

- sells for 650 thousand in less than three years;

- 650-500=150/100*13= 19.5 тысяч.

If the car is sold cheaper than it was bought at one time, then, accordingly, the owner does not receive any income, which means that there is no need to pay tax. However, this is only possible if you can document everything.

Based on these facts, the owner must decide for himself what is better for him to use - a tax deduction or payment of tax on the difference. Whatever method you choose, and regardless of whether you need to pay tax or not, you must submit a declaration of the established form to the tax office no later than before the end of April of the next year. A financial document must be attached to the declaration - a contract of sale with a specified amount (for individuals this will be quite enough), a cashier's check, a payment order, etc.

If you have owned your car for more than three years, then you should not worry about taxes at all.

Loading…