Checking the bonus-malus ratio

Content

From time immemorial, an insurance contract has been distinguished by an aleatory (risk) character, that is, depending on the circumstances of reality, the insurer could both make a big profit and remain “in the red”. In the insurance business, any professional company tries to calculate all the opportunities for profit and potential risks in order to avoid economic collapse. To do this, one of the key coefficients in the field of auto insurance is CBM (bonus-malus coefficient).

Concept and value of KBM

Translated from Latin, bonus means "good" and malus means "bad." This sheds light on the principle of calculating the insurance indicator: everything bad that happened to the motorist (insured events) and everything good (accident-free driving) is taken into account.

In general, there are several approaches to understanding the bonus-malus coefficient, which differ only in the subtleties of the interpretation of the term, but have the same essence. CBM is:

- a system of discounts for the driver for driving without an accident;

- a method for calculating the cost of insurance, taking into account the previous experience of the occurrence of insured events with the driver;

- a system of ratings and rewards for drivers who do not apply for insurance payments and do not have insured events due to their own fault.

No matter how we look at this concept, its essence is to reduce the price of an OSAGO insurance policy for the most responsible drivers who for a long time manage to avoid the onset of insured events with their car and, as a result, applications for insurance compensation. Such drivers bring the greatest amount of profit to auto insurers, and therefore the latter are ready to show maximum loyalty when determining the price of insurance. In emergency driving, the opposite pattern applies.

Methods for calculating and checking KBM for OSAGO

Depending on the circumstances, it is more convenient for some people to independently calculate their possible BMF, while for others it is easier to turn to official databases and get information in a finished form. However, in disputable situations, when the KBM calculated by the insurer differs from the one expected by the car owner in an unfavorable direction, it is very useful to be able to independently calculate your coefficient.

Calculation of KBM according to the table of values

To calculate the bonus-malus coefficient for OSAGO, we need the following information:

- driving experience;

- history of claims for insurance claims in recent years.

Calculations for determining the CBM are carried out on the basis of a table adopted in all insurance companies in Russia.

A new concept in the table is "car owner class". In total, 15 classes can be distinguished from M to 13. The initial class, which is assigned to car owners who had no previous experience in driving a vehicle, is the third. It is he who corresponds to a neutral KBM equal to one, that is, 100% of the price. Further, depending on the decrease or increase of the car owner in the class, his KBM will also change. For each subsequent year of accident-free driving, the driver's bonus-malus ratio decreases by 0,05, that is, the final price of the insurance policy will be 5% less. You can notice this trend yourself by looking at the second column of the table from top to bottom.

The minimum value of KBM corresponds to the class M. M stands for malus, known to us by the name of the coefficient under discussion. Malus is the lowest point of this coefficient and is 2,45, that is, it makes the policy almost 2,5 times more expensive.

You may also notice that the BSC does not always change by the same number of points. The main logic is that the longer the driver drives the car without the occurrence of insured events, the lower the coefficient becomes. If in the first year he had an accident, then there is the greatest loss in the KBM - from 1 to 1,4, that is, a rise in price by 40% for the policy. This is due to the fact that the young driver has not proven himself in any way positively and has already had an accident, and this calls into question the level of his driving skills.

Let's give an example to consolidate the ability to use the table and easily calculate the BMF from the individual data you have. Let's say you've been driving your personal car without an accident for three years. Therefore, you get a class 6 car owner with a bonus-malus ratio of 0,85 and a 15% discount on the price of a standard insurance policy. Let's further assume that you were involved in an accident and applied to your insurer for a refund during that year. Due to this unfortunate event, your class will be downgraded by one point, and the MPC will increase to 0,9, which corresponds to only 10% of the discount. Thus, one accident will cost you a 5% increase in the price of your insurance policy in the future.

To determine the class, information on contracts that ended no more than a year ago is taken into account. Therefore, when the break in insurance is more than a year, the bonus is reset to zero.

Table: definition of KBM

| Car owner class | KBM | Changing the class of the car owner due to the occurrence of insured events for the year | ||||

| 0 payouts | 1 payout | 2 payouts | 3 payouts | 4 or more payments | ||

| M | 2,45 | 0 | M | M | M | M |

| 0 | 2,3 | 1 | M | M | M | M |

| 1 | 1,55 | 2 | M | M | M | M |

| 2 | 1,4 | 3 | 1 | M | M | M |

| 3 | 1 | 4 | 1 | M | M | M |

| 4 | 0,95 | 5 | 2 | 1 | M | M |

| 5 | 0,9 | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 7 | 4 | 2 | M | M |

| 7 | 0,8 | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 9 | 5 | 2 | M | M |

| 9 | 0,7 | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | 13 | 7 | 3 | 1 | M |

Video: about checking the KBM according to the table

Checking the KBM on the official website of the RSA

Sometimes it is useful to look at yourself through the eyes of an insurer and understand what kind of discount you are entitled to. The most convenient way to get access to official information for free is the official website of the PCA. It should be noted that literally in recent months it has undergone major changes, becoming more modern and convenient to use.

In general, you only need to take these few simple steps to get the information of interest about the bonus-malus coefficient:

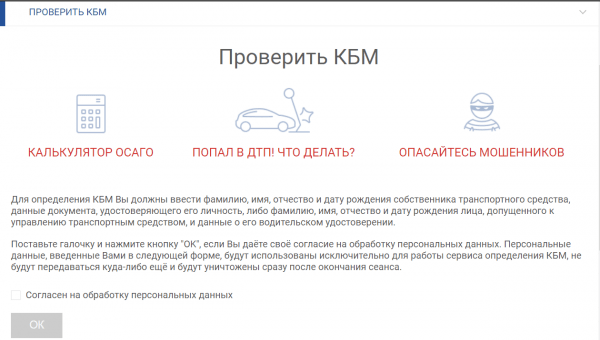

- Go to the official portal of the RSA. The Check KBM page is located in the Calculations section. There you must check the box expressing consent to the processing of personal data, and also click the "OK" button.

Do not forget to agree to the processing of personal data, because without this it is impossible to check the KBM

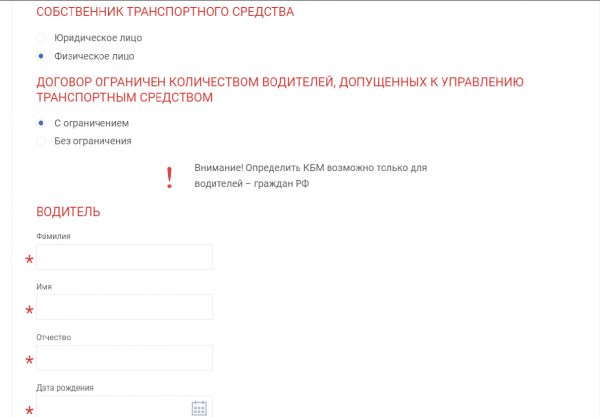

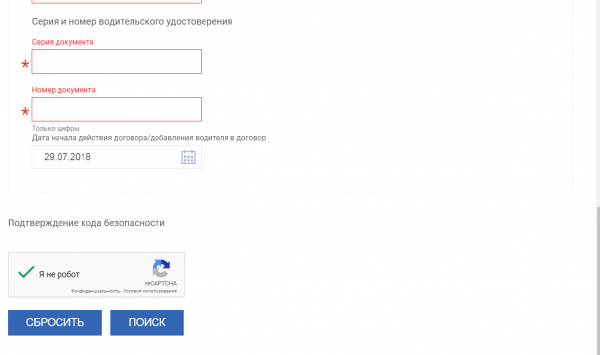

Do not forget to agree to the processing of personal data, because without this it is impossible to check the KBM - By clicking on the "OK" button, you will be taken to the page of the site with fields to fill out. Mandatory lines are marked with a red asterisk. After entering the data, do not forget to pass the "I'm not a robot" check by ticking the appropriate box.

It should be remembered that KBM data is available only for drivers who are citizens of the Russian Federation

It should be remembered that KBM data is available only for drivers who are citizens of the Russian Federation - Finally, click the "Search" button and check out the results displayed in a separate window.

If according to your data there is an incorrect display of the KBM, you should contact the insurer for clarification

If according to your data there is an incorrect display of the KBM, you should contact the insurer for clarification

The PCA database is the most reliable external source of information, as it accumulates data from all insurance companies. If the insurer's coefficient differs from that indicated on the website, he is obliged to check it and recalculate it.

Video: BCC calculation using the official portal of the Russian Union of Motor Insurers

Watch this video on YouTube

Ways to restore KBM

For a number of reasons, your coefficient, when checked on the official website of the PCA, may not be displayed adequately to the real circumstances and your calculations made according to the table. As a rule, mistakes with the KBM lead to a significant increase in the cost of the compulsory insurance policy for "motor citizen" and, therefore, will increase the already serious burden on your personal budget. The reason for the failure in the calculation of the coefficient can be:

- human factor (error of an insurance agent when recording personal data);

- planned change of a driver's license (if the insurer was not notified about this);

- execution of an "unlimited" OSAGO policy;

- inclusion in the insurance of more than one person (the assessment of the MSC will be made at the lowest). For example, if a car owner with a BMF of 0,9 and 0,6 is included in the insurance, then the discount will be 10%, not 40%;

- declaring an auto insurance company that you used to use for bankruptcy.

Restoration of the bonus-malus coefficient on the PCA website

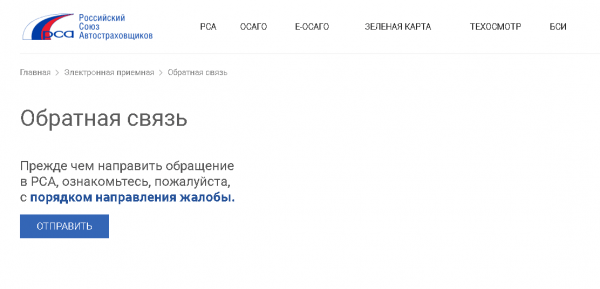

One of the easiest ways to restore KBM is an online appeal to the Russian Union of Motor Insurers on their official website. To do this, you only need Internet access and a little time to fill out and submit an application.

Make a complaint against the insurance company on a standard form or a free-form appeal if its essence is not related to the actions of the insurer. You can send the document by e-mail request@autoins.ru or via the "Feedback" form.

Mandatory details for specifying, without which the application will not be considered:

- F. I. O. in full;

- Date of Birth;

- driver's license number with a copy of the driver's license (or passport - for contracts concluded on terms that do not limit the number of persons allowed to drive a vehicle).

PCA will not make corrections to the database itself. The application will oblige the insurer to recalculate the coefficient and submit the correct information.

Features of the restoration of KBM in the absence of old CMTPL policies

As a rule, the most favorable bonus-malus coefficient has drivers with a fairly long experience of accident-free driving (10 years or more). In such circumstances, it is quite difficult to keep all the required documents from the insurance companies. This is especially true for those car owners who have repeatedly changed the insurer.

Fortunately, according to the letter of the law, there is no need to collect and store insurance policies for the entire time you drive a car. So, in accordance with paragraph 10 of article 15 of the Federal Law "On OSAGO" No. 40-FZ contains the following useful duty of the insurer:

Upon termination of the compulsory insurance contract, the insurer shall provide the insured with information on the number and nature of the insured events that have occurred, on the insurance indemnity carried out and on the forthcoming insurance indemnity, on the duration of insurance, on the considered and unsettled claims of the victims for insurance indemnity and other information on insurance during the period of validity of the compulsory insurance contract. insurance (hereinafter referred to as insurance information). Information about insurance is provided by insurers free of charge in writing, and is also entered into the automated information system of compulsory insurance created in accordance with Article 30 of this Federal Law.

Finally, in addition to a free written reference, the insurer is also required to promptly enter information about insurance into the OSAGO AIS database, from which your new insurance company can receive them.

Other ways to restore KBM

Applying to the RSA is far from the only, and in fact, not the most effective way to restore justice in matters of verifying the correctness of the calculation of the KBM. Here are just a few alternative methods:

- complaint to the insurance company;

- complaint to the Central Bank;

- paid online resources;

- insurance agents.

Contacting an insurance company

Due to changes in legislation that have taken place in the last few years, contacting the IC directly, which applied the wrong coefficient value, is the most preferable option. The fact is that from the end of 2016, upon receipt of an application from the insured person, the insurer is obliged to independently verify whether the coefficient applied or to be applied corresponds to the value contained in the AIS PCA. In addition, only insurers have the right to submit data on contracts and insured events for inclusion in the PCA database.

Almost any insurance company now has a website where you can complain about an incorrect calculation of KBM without wasting time on a personal visit.

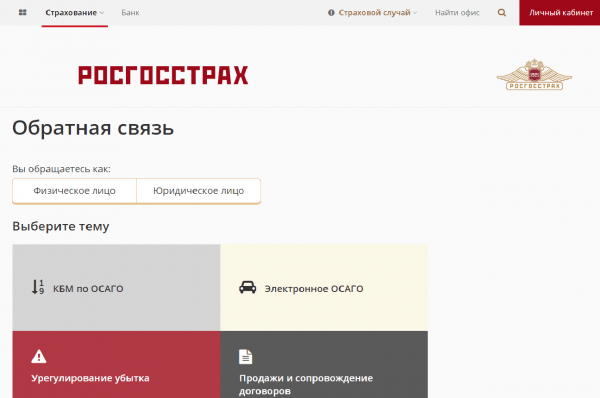

Let's take as an example such a page on the website of the most popular insurer in Russia - Rosgosstrakh. Here are the steps to submit a request:

- First of all, you should go to the Rosgosstrakh Insurance Company website and find a page for leaving requests called "Feedback".

Before making a specific request to the company, it is necessary to check the boxes “individual / legal entity” and select a topic

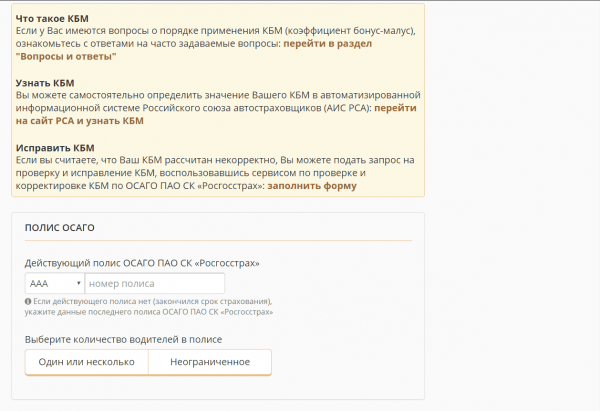

Before making a specific request to the company, it is necessary to check the boxes “individual / legal entity” and select a topic - Next, at the bottom of the page, select "Fill out the form" and fill in all the columns that are marked as mandatory.

Filling in all the data about the policy and the applicant himself will allow the CSG to verify the correctness of the calculation of the KBM

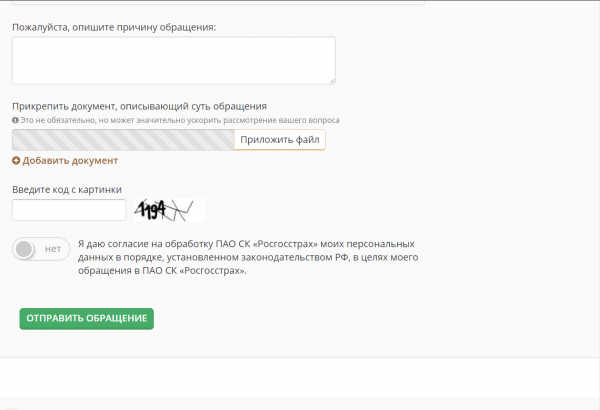

Filling in all the data about the policy and the applicant himself will allow the CSG to verify the correctness of the calculation of the KBM At the end, you must enter the code from the picture and agree to the processing of data, as well as send an appeal by clicking the green button at the bottom of the page.

Without passing the verification by entering the code from the picture and consent to the processing of personal data, it is impossible to send an appeal

Without passing the verification by entering the code from the picture and consent to the processing of personal data, it is impossible to send an appeal

In general, all feedback forms are very similar and require the following information:

- details of the insurance policy;

- the number of drivers and the details of each of them (full name, date of birth, passport and driver's license data);

- data of the vehicle itself (VIN, state number).

The difference lies only in the convenience and colorfulness of the interface of the insurer's website.

Complaint to the Central Bank

One of the most effective ways, if contacting the insurance company did not give the desired result, is to file a complaint with the Central Bank of Russia (CBR). To do this, you must do the following:

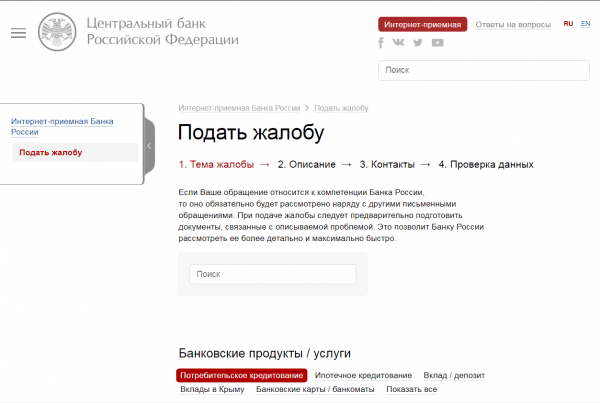

- Go to the Central Bank's "Submit a Complaint" page.

By going to the appropriate page of the Central Bank website, you will have to choose the subject of the complaint from the options below

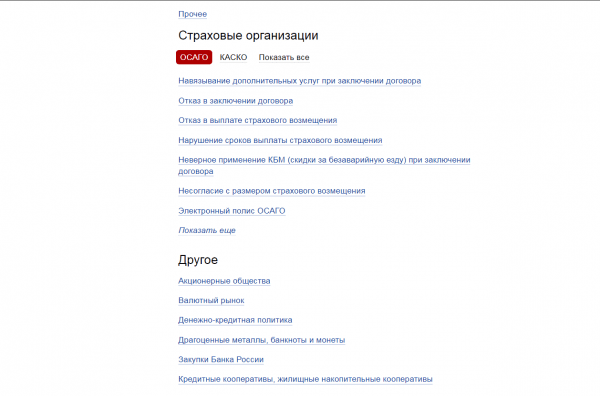

By going to the appropriate page of the Central Bank website, you will have to choose the subject of the complaint from the options below - In the "Insurance organizations" section, select OSAGO, and from the list below - "incorrect use of KBM (discounts for accident-free driving) when concluding a contract."

Insurers are supervised by the Central Bank of the Russian Federation, so writing complaints against them at this address is not an empty exercise

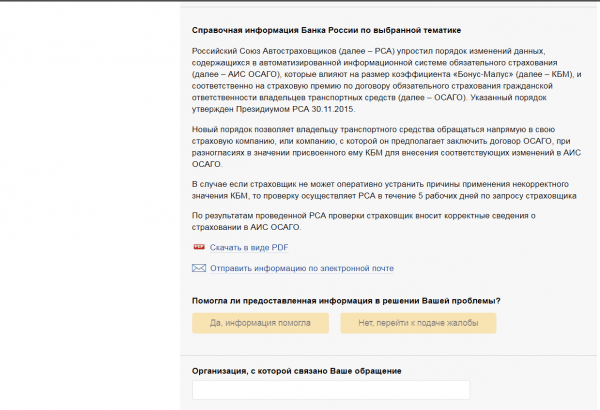

Insurers are supervised by the Central Bank of the Russian Federation, so writing complaints against them at this address is not an empty exercise - Read the information and click "No, proceed to file a complaint". A number of windows will open in front of you, which must be filled out.

To be able to write an appeal, it should be noted that the information provided did not help you

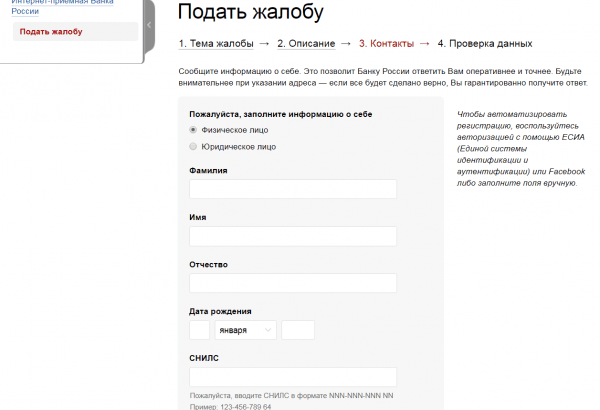

To be able to write an appeal, it should be noted that the information provided did not help you - After clicking the "next" button, fill in your personal details and the complaint will be sent.

Accurate (in accordance with official documents) filling in of passport data guarantees consideration of the application, since the Central Bank has the right to ignore anonymous requests

Accurate (in accordance with official documents) filling in of passport data guarantees consideration of the application, since the Central Bank has the right to ignore anonymous requests

Paid online services

Today, there are many offers on the network from commercial online structures that, for relatively little money, offer their services for the restoration of KBM without leaving home.

If you still decide to turn to such sites for help, then follow the advice of ordinary motorists who were satisfied with the quality of services and the honesty of the intermediary.

Video: more about how to restore the ratio

Watch this video on YouTube

MBM is an essential variable that, depending on the circumstances, can either increase the cost of your OSAGO policy or halve it. It is extremely useful to learn how to use the table and independently calculate your coefficient, so that in case of errors of insurers, in time to apply for their correction to the insurance company itself or to supervisory authorities (Central Bank) and professional associations (Russian Union of Motor Insurers).