How to check a car for collateral in a bank? According to Mrs. number

Today, the situation has changed, as various services have appeared to check movable property for encumbrances. You can check the car by its registration number, VIN code, or according to the seller's data - full name, driver's license number, passport details, TIN.

How to determine that a car was bought on credit?

If you decide to buy a used car, you need to check its legal status very carefully. It is no secret that various fraudulent schemes are very common today, when gullible buyers are sold mortgaged, and even worse, stolen vehicles. The fact that this vehicle has debts for traffic police fines, recycling fees, customs duties or transport tax will also not be very pleasant. When the car is re-registered to a new owner, all debt repayment obligations are also transferred to him.

What causes suspicion when buying a used car:

- There are no payment documents for the purchased car;

- The vehicle was owned by the previous owner for a short time;

- the owner does not provide you with a contract of sale;

- the price is significantly lower than the average market;

- in the CASCO agreement, not an individual, but a banking organization is indicated as a beneficiary.

It is worth noting that even in the absence of all these suspicious points, it is still better to conduct a comprehensive check of the vehicle. By a comprehensive check, we mean not only a complete diagnosis, but also the legal purity of the purchased car.

Register of pledges of the Notary Chamber

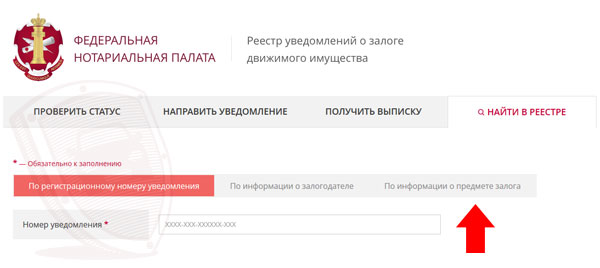

The website "Register of Pledges" of the Federal Notary Chamber appeared at the end of 2014. In theory, it should contain information about any collateral, and not just about cars. The disadvantage of this resource is that entering information into the register is voluntary, that is, some banks may cooperate with the chamber, while others refuse this cooperation, respectively, there is no 100% certainty that you will find information on this vehicle.

There are other disadvantages:

- only notaries are entitled to receive official extracts;

- the average cost of the service in Russia is 300 rubles;

- information is updated late;

- rather complicated form to fill out.

That is, anyone can use this site. To do this, you only need to know the VIN code of the car and enter it in the appropriate form: “Find in the registry” - “According to information about the subject of pledge” - “Vehicle” - “Enter the VIN code”. However, do not rejoice if the window “No results were found for this query” pops up, as this may mean that the bank managers did not bother to enter the vehicle into the register. Only obtaining an extract from a notary can be a guarantee that the car is not collateral. The extract is an official document and can be used in court as evidence of the legal acquisition of the car. Therefore, if you have doubts about the honesty of the seller, do not neglect the notary's verification.

National Credit Bureau

This online resource also offers a vehicle check service. Its disadvantage is that only legal entities have access to databases. If you want to get an official statement on the status of the car, you, again, will have to contact a notary and pay 300 rubles for his help.

NBKI does not cooperate with all banking organizations, but only with some. To receive information about the deposit, you need to indicate the VIN code or the PTS number, in response you will receive an electronic statement, which will contain the following information:

- information about the person who issued the loan;

- the date of the end of the pledge;

- vehicle information.

There are other sites that offer checking cars for collateral. All of them draw information from the two resources listed above. Services are paid - 250-300 rubles.

Here are these sites:

- https://ruvin.ru/;

- https://www.akrin.ru/services/cars/;

- https://www.banki.ru/mycreditinfo/.

Information is provided only by the PTS number or VIN code.

Check for restriction of registration actions

We have repeatedly mentioned on Vodi.su the official website of the traffic police, where you cannot get information about the pledge, but you can find out about the presence of restrictions on registration actions by registration numbers, VIN code, PTS or STS number. Such a ban may be imposed due to debts on traffic police fines, due to the fact that the vehicle is included in the database of stolen cars, or the ban is imposed by a court decision, a decision of the bailiff service or investigating authorities. It is clear that buying such a car is undesirable. Checking is absolutely free.

You can also check the seller himself according to his passport data on the website of the Federal Bailiff Service. If a person is included in the register, then enforcement proceedings are being conducted against him, so it is better to refuse the transaction.

As you can see, no one will give you a 100% guarantee. That is why we strongly recommend ordering an extract from a notary's office. Even if it later turns out that the car is collateral, according to Art. Civil Code of the Russian Federation 352, you can be recognized as a bona fide buyer, that is, at the time of the conclusion of the DCT, you used all means to verify the legal purity of the vehicle, and physically could not know that it was bought on credit. In this case, the bank will not be able to bring any charges against you. You need to check not only used cars bought from hands, but also those purchased in Trade-in salons, since here there is a possibility of buying mortgaged cars.

Loading…