Worth checking insurance options

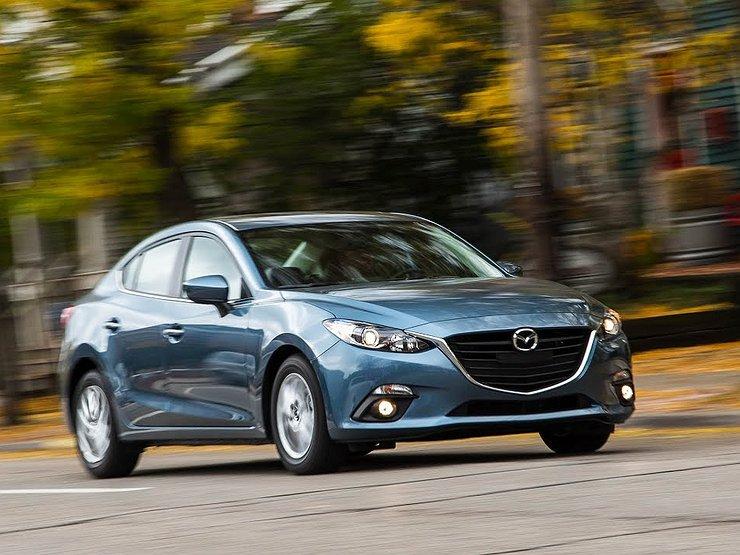

Worth checking car insurance options

Just paying for an insurance renewal without a second thought can leave a big hole in your pocket.

Companies often rely on customers being lazy and unable to figure out if they can get a better deal.

All customers need to do is call their own or competing insurers to see if they can get a better deal.

When your policy update arrives in the mail, there are a few steps you need to take to make sure you don't get a raw end of the deal.

Price

Understandinsurance.com.au spokesperson Campbell Fuller says there's a lot to choose from and customers shouldn't be complacent when a renewal notice comes in the mail, no matter what type of insurance it is, from auto to home or health.

“It is often tempting to change insurers to find a better price. However, price is only one of the considerations,” he said.

A "set it and forget it" approach is not recommended for auto insurance policies.

"If you have a cheaper offer, you can contact your insurance company to see if they offer a better deal."

Insurers often provide discounts if you subscribe to more than one form of insurance.

Comparison of policies

Reading the fine print of an insurance policy isn't fun, but consumers should do it to make sure they know what they're covered for and what isn't.

Fuller says it's important to study politics carefully.

“Policies differ in what is included or excluded, coverage limits, disclosure requirements, and the deductible amount you pay when you apply,” he said.

Know the additional fees and also check if there are exclusions or other conditions in the policy that may affect your level of coverage.

Always be honest when receiving a quote - if you don't, you could be left uninsured.

Competition

Insurance companies continue to escalate their advertising for enticing deals to attract new customers, and iSelect spokeswoman Laura Crowden says it's good for those looking for competitive deals.

“Increasing competition among insurers means more providers than ever are actively competing for your business,” she said.

"It's important to take advantage of this and get the right policy at the right price."

She encourages clients not to apply the "set it and forget it" approach to their policies and to ensure that their new policy is applicable to their circumstances.

CarsGuide does not operate under an Australian financial services license and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) for any of these recommendations. Any advice on this site is general in nature and does not take into account your goals, financial situation or needs. Please read them and the applicable Product Disclosure Statement before making a decision.